July 28, 2020

The Markets

Where are we on vaccines and treatments?

During 2020, the United States government has spent more than $13 billion on Operation Warp Speed (OWS), which is focused on accelerating the development of vaccines and treatments for COVID-19, according to The Economist. The United States is not alone. Governments around the world are funding similar research.

The Economist reported, “…with the eagerness of the pharma sector to find treatments, along with the broad range of investments made by OWS (as well as other governments), there has been a lot of progress in the search for tests, drugs, and vaccines…Even the master of caution on vaccines, Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, thinks a signal of vaccine efficacy might arrive in September.”

Any progress on treatments and vaccines is welcome news. Last week, there were more than 4 million confirmed COVID-19 cases in the United States, and the number of deaths rose above 1,000 a day, reported Joe Murphy and colleagues at NBC News. Late in the week, the number of new cases in Arizona, Florida, and South Carolina appeared to be trending lower, according to data from the Coronavirus Research Center at Johns Hopkins.

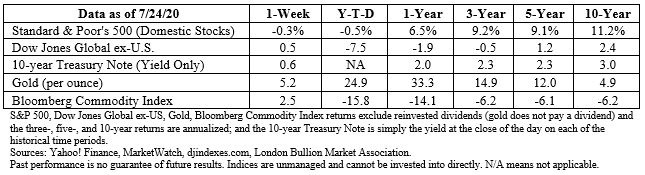

The resurgence of the virus may be one reason for the decline in U.S. stock markets last week. The Nasdaq Composite Index delivered back-to-back losses for the first time in more than a month, while the Dow Jones Industrial Average and the Standard & Poor’s 500 Index finished the week slightly lower, reported Ben Levisohn of Barron’s.

It’s difficult to pinpoint the exact cause of the drop because there were many possible drivers. For instance, the Department of Labor reported the number of new unemployment claims increased, after 15 weeks of declines. Markets may have been concerned about increasing unemployment numbers when the extra $600 in weekly unemployment benefits expires at the end of this week. Congress has yet to agree on whether or how to extend benefits.

In addition, earnings have been less than stellar – as expected. Last week, 26 percent of companies in the Standard & Poor’s 500 Index had reported second quarter results. The blended earnings, which combine actual results for companies that have reported with the estimated results for companies that have not yet reported, were down 42.4 percent, reported John Butters of FactSet.

There is little doubt the virus has wrought economic havoc. Let’s hope we find a vaccine soon. Future generations may think about COVID-19 the way we now think about polio, measles, and rubella.

What Do You Know About Money?

The terms money and currency are often used interchangeably. However, Andrew Beattie of Investopedia pointed out, “According to some theories, money is inherently an intangible concept, while currency is the physical (tangible) manifestation of the intangible concept of money. By extension…money cannot be touched or smelled. Currency is the coin, note, object, etc…”

See what else you know – or don’t – about money by taking this brief quiz:

- Which of the following was once used as currency?

a. Tea bricks

b. Knives

c. Animal skins

d. All of the above

- Which was the first animal to appear on a U.S. coin?

a. An eagle

b. A buffalo

c. A jackalope

d. A ring-necked pheasant

- What were nickels made of during WWII (1942-1945)?

a. Nickel

b. Metal alloy

c. Steel

d. Leather

- What is chrometophobia?

a. Fear of thinking about money

b. Fear of spending money

c. Fear of touching money

d. All of the above

Weekly Focus – Think About It

“A nickel ain't worth a dime anymore.”

—Yogi Berra, Professional baseball player

Answers:

- D – All of the above (Tea bricks, Knives, and animal skins)

- A – Eagle

- B – Metal alloy

- D – All of the above (Fear of thinking about money; fear of spending money; and fear of touching money)

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.economist.com/united-states/2020/07/18/donald-trump-is-hoping-for-a-covid-19-treatment-by-november (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-27-20_TheEconomist-Donald_Trump_is_Hoping_for_a_COVID-19_Treatment_by_November-Footnote_1.pdf)

https://www.nbcnews.com/health/health-news/coronavirus-deaths-united-states-each-day-2020-n1177936

https://coronavirus.jhu.edu/data/new-cases-50-states (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-27-20_JohnsHopkins-Daily_Confirmed_New_Cases-Footnote_3.pdf)

https://www.barrons.com/articles/tech-stocks-tanked-blame-it-on-the-value-of-the-dollar-51595638215?refsec=the-trader (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-27-20_Barrons-Another_Reason_Tech_Stocks_Tanked-A_Weak_Dollar-Footnote_4.pdf)

https://www.dol.gov/ui/data.pdf

https://www.cnbc.com/2020/07/23/weekly-jobless-claims.html

https://insight.factset.com/sp-500-earnings-season-update-july-24-2020

https://www.cdc.gov/globalhealth/immunization/default.htm

https://www.investopedia.com/articles/07/roots_of_money.asp

https://www.usmint.gov/learn/kids/coins/fun-facts

https://turbo.intuit.com/blog/relationships/chrometophobia-fear-of-money-4734/

https://www.brainyquote.com/quotes/yogi_berra_106829

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe