Financial Planning: How to Set Yourself Up for Success.

Sure, the stock market is an exciting way to try to make big bucks, but financial planning, with a focus on tax minimization, is where real wealth is earned. And it's far more relaxing.

Call 203-967-2231 or email us to get started.

Minimize Your Tax Burden to Maximize Your Wealth

Have you have put in long hours, saved your money, and invested prudently, but you still haven't attained your financial goals? It’s time to call us. We’ll help figure out how your financial world fits together — and if you can make your money work harder for you, for a change.

We Never Push You Unless It's Toward Your Own Goals.

We don't work on commission – which means we'll never advise you to trade or buy just so we can make a quick dollar. We follow the plan, and our team of legal, financial, insurance, and real estate experts help keep all the components of that plan working in unity.

Investing 101: The Power of Compound Interest

One of the best arguments for planning your finances as early as possible is the effect of compound interest. Setting aside a modest amount of money and directing it to be re-invested over time can result in huge gains for little effort.

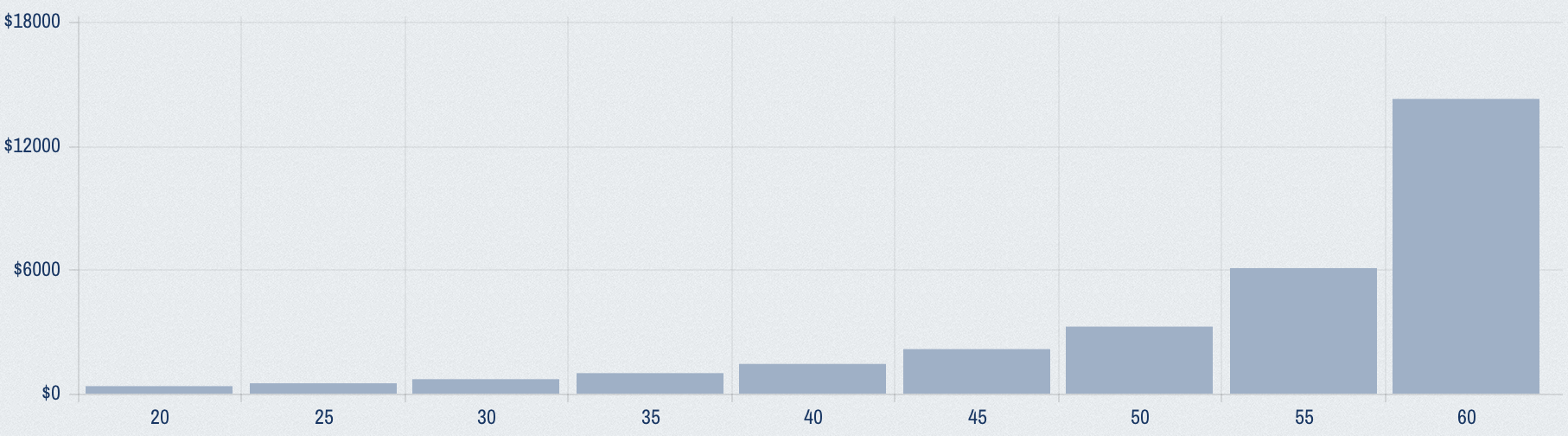

In the chart below, we've graphed the effects of a simple scenario: at 6% interest, how much does a person need to set aside each month in order to have 1 million dollars by age 65? Interact with the graph and you'll see: by starting to invest in your 20s, your monthly payments can be drastically lower than someone starting in his 40s or later. Someone consulting with an experienced financial advisor could see even better results!

Monthly Contribution Required to Reach $1M by Age 65

“The best time to plant a tree was 20 years ago. The next best time is now.”—Chinese proverb

Let's get to work on your financial plan. Call 203-967-2231 or email us to begin.

Reach Out