July 21, 2020

Please Join Us Tomorrow for “Greenwich Small Businesses and the Impact of the Pandemic”

Press reports on the economic downturn caused by the COVID-19 pandemic refer to the looming collapse of many small businesses in the country. According to a poll by the U.S. Chamber of Commerce more than 40% of this nation’s 30 million small businesses could close permanently this year. The Greenwich Retired Men’s Association has organized a panel discussion to see how the pandemic has impacted some of the small businesses in our town.

Sean Dowling will speak on the effectiveness of government-related programs in response to the pandemic, including the PPP and CARES Act. In addition, owners of three Greenwich-based small businesses will talk about how the pandemic is affecting their businesses. You can read more about the speakers’ backgrounds on the Greenwich RMA’s website.

Event Information:

- Date and time: Wednesday, July 22, 2020, 11:00 a.m. ET

- Join the Zoom meeting using this link: https://bit.ly/30IBj21

We hope you will join us for this discussion!

The Markets

Is the United States economy recovering or faltering?

It depends on who you ask and which data you consider. For example, last week, the Department of Labor reported fewer people applied for first-time unemployment benefits during the week of July 11. That could be a tick in the positive data column. Week-to-week the number declined from 1.31 million to 1.30 million. The lackluster decline could be a tick in the negative data column since the long-term weekly average is about 20 percent of that number.

There was positive news about progress on COVID-19 vaccines last week. The hope it inspired was tempered by reports the number of new cases continued to grow in a majority of U.S. states.

Concern about the resurgence of the virus negatively affected consumer sentiment during the first half of July. The University of Michigan Consumer Sentiment Survey reported, “The promising gain recorded in June was reversed, leaving the Sentiment Index in early July insignificantly above the April low (+1.4 points).”

Uncertainty is reflected in the divergent stories told by stock and bond markets.

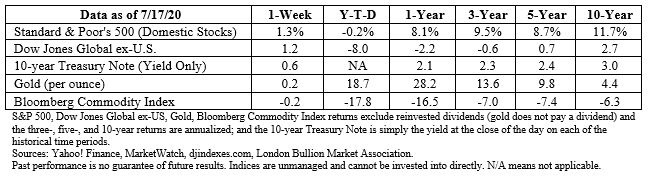

The year-to-date return for the Standard & Poor’s 500 Index moved briefly into positive territory last week before finishing slightly down, reported Financial Times. That’s an impressive run for a benchmark that was down more than 30 percent in late March. Meanwhile, the tech-heavy Nasdaq Composite has been in positive territory for a while.

Last week, Mike Wilson, Chief U.S. Equity Strategist at Morgan Stanley said, “The bottom line, equity markets have been telling us growth is going to surprise on the upside.”

Bond markets have been less optimistic. Yields on U.S. Treasuries remain exceptionally low, suggesting investors continue to seek safe havens amidst uncertainty about the future. On January 2, 2020, 10-year Treasury notes yielded 1.88 percent. Last week, the yield was 0.63 percent.

On a recent earnings call, Jamie Dimon, chairman of JPMorgan Chase, shared his thoughts on the state of the economy. “Can I just amplify it? In a normal recession unemployment goes up, delinquencies go up, charge-offs go up, home prices go down; none of that's true here…Savings are up, incomes are up, home prices are up. So you will see the effect of this recession; you're just not going to see it right away because of all the stimulus…you're going to have a much murkier economic environment going forward than you had in May and June, and you have to be prepared for that…”

Markets may remain volatile until the economic picture gains some clarity.

Stop Making Cents?

You may not have noticed, but there is a coin shortage in the United States. National Public Radio explained:

“Supermarkets and gas stations across the U.S. are asking shoppers to pay with a card or produce exact change when possible. [A big box store] has converted some of its self-checkout registers to accept only plastic. [A grocery chain] is offering to load change that would normally involve coins onto loyalty cards.”

Social distancing, and other safety measures taken to slow the spread of COVID-19, also slowed the U.S. Mint’s coin production. In June, the Federal Reserve began rationing coins, and convened a task force to investigate the issue.

With coins in the public eye, it may be time to resurrect the ‘Kill the penny’ movement, suggested Greg Rosalsky of Planet Money.

In 2019, 60 percent of the coins produced by the U.S. Mint were pennies. The majority of the Mint’s coin-producing time was spent making about seven billion pennies. The problem is pennies cost more to produce than they are worth as currency.

According to the U.S. Mint’s 2019 Annual Report, “The unit cost for both pennies (1.99 cents) and nickels (7.62 cents) remained above face value for the fourteenth consecutive fiscal year.” In other words, the Mint lost more than $72 million making pennies last year.

How often do you use pennies and nickels?

Weekly Focus – Think About It

“Money often costs too much.”

—Ralph Waldo Emerson, Philosopher and essayist

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.dol.gov/ui/data.pdf

https://fred.stlouisfed.org/series/ICSA

https://finance.yahoo.com/news/stock-market-news-live-july-15-2020-221127015.html

https://www.ft.com/content/f6047438-1ea1-4524-8eb1-288f611ece54 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-20-20_FinancialTimes-Stocks_Close_Higher_for_Third_Straight_Week-Footnote_6.pdf)

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-20-20_Barrons-Market_Data-Footnote_7.pdf)

https://www.morganstanley.com/ideas/thoughts-on-the-market-wilson (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-20-20_MorganStanley-US_Markets_Weight_Optimism_Uncertainty-Footnote_8.pdf)

https://www.jpmorganchase.com/corporate/investor-relations/document/2q20-earnings-transcript.pdf

https://www.npr.org/sections/money/2020/07/14/890435359/is-it-time-to-kill-the-penny

https://www.usmint.gov/about/reports (Click on 2019, page 10)

https://www.forbes.com/sites/robertberger/2014/04/30/top-100-money-quotes-of-all-time/#7ec10d224998

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe