July 14, 2020

The Markets

Please don’t scream inside your heart.

Last week, a reopened Japanese theme park asked patrons to wear masks to help reduce the spread of coronavirus. It also asked them not to scream while riding the rollercoaster. “Please scream inside your heart,” park management urged.

During 2020, stock markets in the United States have taken investors on an emotional rollercoaster ride. By late March, the Standard & Poor’s 500 Index had lost more than 30 percent. The Index has since regained most of those losses, although there have been many ups and downs along the way.

The culprits behind market volatility have been fear and uncertainty, often inspired by twists and turns in the coronavirus saga. Last week, as stocks faltered and demand for U.S. government bonds surged, Eric Platt and Colby Smith of Financial Times reported:

“The strong demand for [safe] haven assets emerged after several U.S. states reported further increases in coronavirus cases, after Florida on Thursday recorded its largest death toll since the crisis spread to the United States. Some succor was provided to nervous investors on Friday after [a pharmaceutical company] released data showing its potential coronavirus treatment…had reduced mortality rates in early trials. That provided a bump to stocks and tempered the gains in Treasuries.”

Volatile markets often cause investors to become uneasy. Sometimes, the emotional rollercoaster causes them to focus on short-term performance rather than long-term financial goals. Today, market fluctuations, in tandem with health concerns, work anxiety, and social distancing requirements, may trigger a stronger response than usual, making investors particularly vulnerable to the emotional biases within us.

If short-term market swings are making you restless or uncomfortable, don’t keep it to yourself. This is a good time to re-evaluate your risk tolerance, review your financial goals, and make sure you have enough cash to meet current needs.

The Coronavirus Effect

COVID-19 has been reshaping Americans’ financial habits. During the second quarter, credit card debt and personal savings data showed, overall, we were spending less and saving more than ever before.

In 2019, when a pandemic was a planning and preparedness exercise for epidemiologists, healthcare professionals, and health officials, the debt Americans accrued on credit cards increased between 2.5 and 4.6 percent each quarter.

Since COVID-19 arrived on our shores and began to spread, credit card debt has fallen dramatically. From January through March, it was down 7.6 percent (the seasonally adjusted annual rate). In early July, the Federal Reserve reported the numbers through May:

- April 2020: -64.8 percent (seasonally adj. annual rate)

- May 2020: -28.6 percent (seasonally adj. annual rate)

Lower spending may have contributed to higher savings. The personal saving rate (PSR) in the United States is the percentage of income left after people spend money and pay taxes each month. It increased dramatically in 2020:

- January 2020: 7.9 percent (seasonally adj. annual rate)

- February 2020: 8.4 percent (seasonally adj. annual rate)

- March 2020: 12.6 percent (seasonally adj. annual rate)

- April 2020: 32.2 percent (seasonally adj. annual rate)

- May 2020: 23.2 percent (seasonally adj. annual rate)

Some believe higher rates of saving are the result of lockdowns and will reverse quickly as states reopen. An analyst cited by Jessica Dickler of CNBC explained, “In a month with large government stimulus payments to the majority of U.S. households and widespread economic shutdowns that largely curtailed discretionary spending, the boost to income and the plunge in spending produced an outsized savings rate.”

The shift in percentages from April to May appear to support the hypothesis. We won’t really know whether Americans will continue to charge less and save more until the pandemic ends.

Weekly Focus – Think About It

“It’s good to have money and the things that money can buy, but it’s good, too, to check up once in a while and make sure that you haven’t lost the things that money can’t buy.”

—George Lorimer, Journalist

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

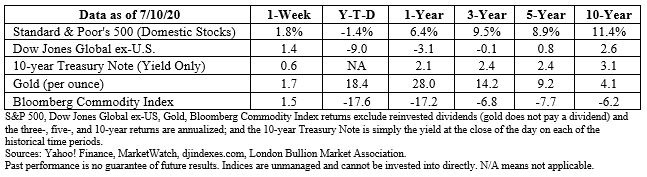

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/market-data?mod=BOL_TOPNAV (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-13-20_Barrons-Market_Data-Footnote_2.pdf)

https://www.ft.com/content/7954d231-0383-414b-acbc-1b6b7db3b4ac (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/07-13-20_FinancialTimes-Treasury_Yields_Hit_Two-Month_Lows_in_Jittery_Week-Footnote_3.pdf)

https://www.morningstar.com/articles/979322/is-recency-bias-swaying-your-investing-decisions

https://www.federalreserve.gov/releases/g19/current/default.htm

https://fred.stlouisfed.org/series/PSAVERT

https://www.bea.gov/sites/default/files/2020-06/pi0520_0.pdf (Table 1, page 6)

https://www.success.com/19-wise-money-quotes/

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe