June 30, 2020

The Markets

Blame it on the coronavirus.

Stock markets in the United States and Europe retreated last week as the number of new COVID-19 cases increased steadily in America. On Thursday, there were more than 44,000 new cases, the highest daily total to date, according to data from the Centers for Disease Control.

“The turn has created a new puzzle for investors, many of whom had started focusing on 2021 earnings expectations as the next performance-driver for stocks. The old market gauges, like manufacturing surveys, jobs tallies, and retail sales, feel like lagging indicators. The new leading indicators deal with the disease. Yet tracking its progress is tricky even for epidemiologists who have studied these issues for decades,” reported Avi Salzman of Barron’s.

Another piece of the investment puzzle was reshaped when the Federal Reserve (Fed) released bank stress test results last week. It found most banks were likely to remain well-capitalized if economic growth rebounds relatively quickly. However, in a worst-case economic recovery scenario, banks did not fare as well. Consequently, the Fed suspended share buybacks and capped the dividends banks can pay investors, reported Alexandra Scaggs of Barron’s.

“The Fed…also said future payouts would depend on bank earnings – and bank earnings will start to look worse as pre-coronavirus quarters drop out and are replaced by COVID-impaired results. Even that decision might not have been a problem if the market believed the spread of COVID was under control. Then the numbers started coming out. Florida’s seven-day average of cases grew 7.8 percent, up from the previous day’s 4.1 percent. Arizona’s jumped to 5.4 percent, from 2.9 percent. In Texas, the positivity rate – that is, the number of tests divided by positive results – hit 11.8 percent,” reported Ben Levisohn of Barron’s.

Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, dispelled the notion this is a second wave of the virus. He told The Wall Street Journal, “People keep talking about a second wave…We’re still in a first wave.”

College Sports Budget Cuts

College and university campuses across the world are facing serious financial shortfalls. “Revenues are plummeting as students (particularly international ones) remain home or rethink future plans, and endowment funds implode as stock markets drop,” reported Alexandra Witze in Nature.

One way some schools are trying to balance budgets is by cutting sports programs. Kendall Baker of Axios News reported athletic directors and conference commissioners are brainstorming ways to lower spending, including reducing travel by focusing on regional play and eliminating conference championship tournaments. The sports affected may include:

- Field hockey

- Men's and women's soccer

- Men's and women's tennis

- Women's lacrosse

- Softball

- Baseball

During the past 12 weeks, 43 Division I teams have been eliminated from the NCAA, reported Baker. “Men's and women's tennis have been hit the hardest, as have Olympic sports like volleyball. That could affect future podiums: 88 percent of American athletes in the Rio Games had played their sport in college.”

Power 5 conferences, which include the Atlantic Coast, Big 12, Big Ten, Pac-12, and Southeastern Conferences have not yet eliminated a sports team. That may change if the highly lucrative football season is cancelled due to COVID and television deals, which account for about a third of revenue, disappear.

A source cited by Ross Dellenger and Pat Forde of Sports Illustrated suggested the accounting may deserve a closer look. So-called ‘non-revenue generating’ sports often generate income for colleges and universities because many athletes pay tuition:

“While trimming their own budget, athletic directors are often hurting their university’s bursar office. Sure, eliminating a men’s track team might save $1 million a year in the athletic budget, but what is it costing the academic side…A track team could be generating over $1 million to the university side.”

Weekly Focus – Think About It

“Do not judge me by my successes, judge me by how many times I fell down and got back up again.”

—Nelson Mandela, Former President of South Africa

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

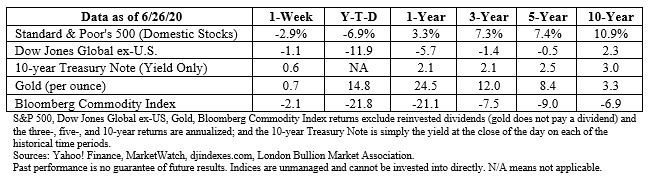

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/market-data (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-29-20_Barrons-Market_Data-Footnote_1.pdf)

https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/cases-in-us.html (Scroll down to New Cases by Day chart) (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-29-20_CDC-New_US_Cases_by_Day-Footnote_2.pdf)

https://www.barrons.com/articles/investors-at-crossroads-as-coronavirus-forces-rethinking-of-reopenings-51593214377?mod=hp_LEAD_2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-29-20_Barrons-Investors_at_Crossroads_as_Coronavirus_Forces_Rethinking_of_Reopenings-Footnote_3.pdf)

https://www.barrons.com/articles/bank-stocks-are-falling-because-the-fed-has-capped-their-dividends-and-suspended-buybacks-51593119624?mod=hp_LEAD_2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-29-20_Barrons-Bank_Stocks_are_Falling_Because_the_Fed_has_Capped_their_Dividends-Suspended_Buybacks-Footnote_4.pdf)

https://www.barrons.com/articles/the-stock-market-just-had-a-very-bad-week-why-it-could-get-worse-51593217141?mod=hp_LEADSUPP_2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-29-20_Barrons-The_Dow_Just_had_a_Very_Bad_Week-Why_It_Could_Get_Worse-Footnote_5.pdf)

https://www.wsj.com/articles/fauci-warns-of-coronavirus-resurgence-if-states-dont-adhere-to-safety-guidelines-11592338771 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-29-20_WSJ-Fauci_Warns_of_Coronavirus_Resurgence_if_States_Dont_Adhere_to_Safety_Guidelines-Footnote_6.pdf)

https://www.nature.com/articles/d41586-020-01518-y

https://www.axios.com/college-sports-coronavirus-crisis-f35a8526-7bcf-4364-96d1-eed6704aef58.html

https://www.britannica.com/list/nelson-mandela-quotes

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe