April 21, 2020

The Markets

Last week’s economic data was about what you might expect in the midst of a virus crisis that has shut down businesses and forced people to stay home:

- Retail sales were down 8.7 percent in March. Retail sales track demand for everything from clothing to refrigerators. The March decline was the worst monthly performance on record, according to Ben Levisohn of Barron’s.

- Oil prices fell further. Saudi Arabia, Russia, and other nations agreed to reduce oil production, but that may not be enough to steady prices. The Economist explained, “Global demand may fall by 29 [million] barrels a day this month, three times the OPEC deal’s promised cuts.”

- Earnings season began with a whimper. Just a sliver (9 percent) of the companies in the Standard & Poor’s 500 Index have reported first quarter earnings. So far, blended earnings (actual results for companies that have reported plus estimated results for companies that have not) are down 14.5 percent for the first quarter, reported John Butters of FactSet.

There were some bright spots, though, that boosted optimism in financial markets.

New York state, where more than 13,000 residents have died as a result of the coronavirus, may be entering a period of deceleration. The number of hospitalizations and deaths moved lower late last week, reported MarketWatch.

Germany announced it is slowly beginning to reopen shops and schools. Guy Chazan of Financial Times reported, “Germany has managed to contain coronavirus more effectively than other European countries, partly thanks to a comprehensive testing regime that allowed authorities to identify and isolate those infected with the virus at an early stage. It has the capacity to run 650,000 tests a week.”

Major U.S. stock markets moved higher last week and expectations for future volatility moved lower.

Five Things To Do If You Just Lost Your Job

During the past four weeks, 22 million Americans have filed for unemployment benefits. It’s an enormous number that reflects the staggering magnitude of job losses due to the coronavirus.

Job loss is painful in any circumstances. It’s particularly intimidating when it occurs in the midst of a pandemic and economic downturn. If you are recently unemployed, here are five things you can do:

- Review your health insurance options. You may have the option to keep your employee health plan for a period of time. It’s temporary and it can be expensive. You pay the entire premium, including the amount your employer used to pay. It may be less expensive to join a spouse’s plan, if that is an option. Another alternative is to purchase a plan through the Health Insurance Marketplace. Losing a job qualifies you for a special enrollment period.

- Get financial advice. We’ll help you evaluate your financial position by reviewing monthly expenditures and available cash, so you know how long you can make ends meet with current financial resources. It may be possible to reduce monthly spending relatively quickly. Banks, credit card companies, and other institutions are allowing customers who call to defer payments because of COVID-19 shutdowns.

- File for unemployment benefits. Ratchet up your patience. State unemployment benefit systems have been overwhelmed by the sheer number of applicants. Completing online forms and filing for weekly payments can take a significant amount of time, so file as soon as you can and be patient.

- Update your resume and LinkedIn profile. Revamp your resume. Polish your LinkedIn profile. Make sure your profile is ‘public’ so people can find you. Join groups that share your interests and passions. Learn more about companies you may want to join.

- Reach out. Start connecting with friends and colleagues. Let them know you are looking for your next opportunity. Consider doing volunteer work or freelancing until you find a new position. Work of any kind will help you stay busy during the times you’re not hunting for a new job.

Weekly Focus – Think About It

“Far and away the best prize that life offers is the chance to work hard at work worth doing.”

—Theodore Roosevelt, 26th American President

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

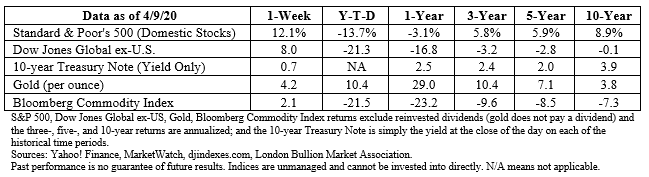

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.investopedia.com/terms/r/retail-sales.asp

https://www.barrons.com/articles/the-stock-market-had-a-breakout-week-unless-you-were-a-small-cap-stock-51587167340?mod=hp_LEAD_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/04-20-20_Barrons-The_Market_had_a_Breakout_Week_Unless_You_were_a_Small-Cap_Stock-Footnote_2.pdf)

https://www.economist.com/leaders/2020/04/16/the-future-of-the-oil-industry (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/04-20-20_TheEconomist-The_Future_of_the_Oil_Industry-Footnote_3.pdf)

https://insight.factset.com/sp-500-earnings-season-update-april-17-2020

https://www.ft.com/content/6751dafc-117a-47d2-ada3-44223254f2d2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/04-20-20_FinancialTimes-Germany_to_Relax_Coronavirus_Lockdown_Measures-Footnote_6.pdf)

https://www.barrons.com/market-data (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/04-20-20_Barrons-Market_Data-Footnote_7.pdf)

https://www.dol.gov/general/topic/health-plans/cobra

https://www.healthcare.gov/have-job-based-coverage/if-you-lose-job-based-coverage/

https://www.finra.org/investors/alerts/job-dislocation-managing-financial-impact-unexpected-job-loss

https://www.experian.com/blogs/ask-experian/covid-19-resource/

https://collegegrad.com/jobsearch/35-inspirational-job-quotes-for-job-seekers

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe