April 14, 2020

As noted previously, we are continuing “business as usual” in a remote-work capacity. If you need to reach us for any reason, simply call or email as you would have before.

The Markets

Why is the stock market doing so well when the COVID-19 pandemic has yet to peak?

At the end of last week, the Centers for Disease Control and Prevention reported the United States remains in the acceleration phase of the coronavirus pandemic. This phase ends when new cases of COVID-19 level off. The next phase should be a period of deceleration, and the number of cases should decline.

There are several different models estimating when a peak may occur, and estimates vary from state to state, according to Sean McMinn of NPR. For instance, the model cited by the White House is from The Institute for Health Metrics and Evaluation at the University of Washington. It assumes social distancing measures will stay in place through the end of May. In this circumstance:

- New York may have peaked April 9

- California may peak April 15

- Pennsylvania on April 17

- Texas on April 28

- North Dakota on April 30

- Wyoming on May 2

All other states have peaked or are projected to peak on or before May 2, 2020.

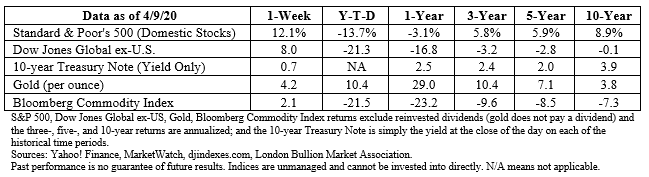

Despite estimates suggesting the virus will continue to spread and businesses may not reopen fully until the end of May, U.S. stock markets moved significantly higher last week. Al Root of Barron’s reported:

“The S&P 500 index rose 12 percent…its best week since 1974 – and finished 25 percent off its March low. The corresponding gain for the Dow Jones Industrial Average was 13 percent, up 27.8 percent from its low. The Nasdaq Composite jumped 10.6 percent, raising it 23 percent off its low.”

Many factors affect U.S. stock market performance, including company fundamentals (how companies perform), investor sentiment (what investors think), consumer sentiment (what consumers think), monetary policy (what the Federal Reserve does), and fiscal policy (what the federal government does). The driver supporting stock market performance last week was Federal Reserve monetary policy. Axios explained:

“The Federal Reserve announced Thursday it will support the coronavirus-hit economy with up to $2.3 trillion in loans to businesses, state and city governments…The slew of new Fed programs comes as economic conditions deteriorate at an unprecedented pace…and another 6.6 million Americans filed for unemployment benefits this week.”

There continues to be uncertainty about how the U.S. economy will recover. As a result, we are likely to see markets remain volatile.

Boredom Sparks Creativity

Early last year, Time Magazine cited a study that found boredom may trigger creativity. Time explained, “In the study, people who had gone through a boredom inducing task – methodically sorting a bowl of beans by color, one by one – later performed better on an idea-generating task than peers who first created an interesting craft activity.”

Recent social media and news reports are providing anecdotal evidence that supports the idea. For example, people are:

- Creating art galleries for pets. A couple of bored 30-year-olds built a mini art gallery for their pet gerbils while on quarantine. The Good News Network reported, “The tiny space was furnished with carefully curated rodent-themed takes on classic works of art – including the ‘Mousa Lisa.’”

- Playing real-life versions of children’s games. In Wales, a nursing home has seniors practicing social distancing while playing a real-life version of Hungry, Hungry Hippos. “Instead of using hippo mouths to capture the plastic balls, however, the women brandished baskets on sticks…,” reported Good News Network.

- Transforming their homes. One clever person transformed glass patio doors into stained glass using painters tape and washable markers, reported BoredPanda.

- Cooking together. Quarantine cooking clubs are catching on. For instance, one club, “…assigns a new dish every weekend; a last meal of one of the celebrities who has been a guest on the James Beard Award nominated podcast, Your Last Meal,” reported the MyNorthwest podcast.

If you’re looking for something to do, the J. Paul Getty Museum (The Getty) in Los Angeles recently asked their followers to select a favorite work of art from their collection and re-create it using three everyday household items. The museum’s blog reported on the results so far:

“You’ve re-created Jeff Koons using a pile of socks, restaged Jacques-Louis David with a fleece blanket and duct tape, and MacGyvered costumes out of towels, pillows, scarves, shower caps, coffee filters, bubble wrap, and – of course – toilet paper and toilet [paper] rolls.”

Weekly Focus – Think About It

“I wanted a perfect ending. Now I've learned, the hard way, that some poems don't rhyme, and some stories don't have a clear beginning, middle, and end. Life is about not knowing, having to change, taking the moment and making the best of it, without knowing what's going to happen next.”

—Gilda Radner, Comedian

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/summary.html

https://www.npr.org/sections/health-shots/2020/04/07/825479416/new-yorks-coronavirus-deaths-may-level-off-soon-when-might-your-state-s-peak#allstates (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/04-13-20_NPR-Coronavirus_State-By-State_Peak_Projections-Footnote_2.pdf)

https://www.barrons.com/articles/the-s-p-500-had-its-best-week-since-1974-next-up-an-economic-coma-51586560230?mod=hp_HERO (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/04-13-20_Barrons-Stocks_Just_had_Their_Best_Week_in_Decades-Get_Ready_for_a_Drop-Footnote_3.pdf)

https://www.axios.com/federal-reserve-coronavirus-lending-3616d77e-e69d-42d7-95bf-6612407cc16a.html

https://time.com/5480002/benefits-of-boredom/

https://www.goodnewsnetwork.org/quarantined-couple-makes-art-gallery-for-gerbils/

https://www.goodnewsnetwork.org/watch-seniors-play-real-life-hungry-hungry-hippos/

https://mynorthwest.com/category/podcast_results/?sid=1148&n=Your%20Last%20Meal%20with%20Rachel%20

https://www.goodreads.com/quotes?page=13

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe