March 31, 2020

As noted previously, we are continuing “business as usual” in a remote-work capacity. If you need to reach us for any reason, simply call or email as you would have before.

The Markets

The United States set some records last week.

First, we became the epicenter of the COVID-19 pandemic. Popular Science explained:

“An increase of 15,000 known cases in just one day pushed the United States past Italy and China, making it the new epicenter of the pandemic…Experts suspect the actual number of U.S. cases is much higher than currently reported…the United States has tested a far lower percentage of its large population than other hard-hit countries.”

On Friday, March 27, the Centers for Disease Control (CDC) reported there were 103,321 confirmed cases and 1,668 deaths in the United States.

Second, as businesses across the country closed, leaving many workers without income, first-time claims for unemployment benefits hit an all-time high of 3.3 million. The previous record of 695,000 was set in 1982, during one of the deepest recessions the United States had experienced to date.

Third, Congress passed the biggest aid package in history. The $2.2 trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act) was signed into law last week. The CARES Act authorizes financial support for workers and businesses, including:

Relief checks. If you earn less than $75,000, and file taxes singly, you can expect a one-time payment of $1,200. If you’re married, you and your spouse will each receive a check. Children will receive $500 each. Social Security benefit recipients will receive checks, too.

Higher unemployment benefits. CARES raised unemployment benefits by $600 a week for four months.

Tax credits for businesses that keep paying employees. Businesses of all sizes are eligible for a tax credit intended to keep workers on the payroll. The credit is up “to 50 percent of payroll on the first $10,000 of compensation, including health benefits, for each employee,” reported NPR.

U.S. stock markets rallied on the news. Some speculated the shortest bear market in history had ended, but Randall Forsyth of Barron’s cautioned, “To anybody who has been around for a market cycle or more, that pop was the very essence of a bear-market rally, and such rallies are the most violent.”

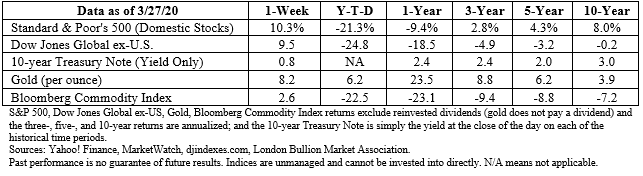

Major U.S. indices moved higher during the week.

Practical Advice for Handling Packages and Groceries

The Washington Post published an article written by Joseph G. Allen, an assistant professor of exposure and assessment science at Harvard’s School of Public Health. Allen explained precautions to take to prevent disease transfer from packages and groceries. (Yes, coronavirus can live on a surface, but the risk of disease transmission is low.)

Here are some of Allen’s suggestions for handling delivery packages:

- Leave packages outside or bring them inside and leave them by the door for several hours.

- Wipe down package exteriors with disinfectant.

- Unwrap packages and leave the packaging in the recycling can.

- Wash your hands after touching a package.

Allen also offered suggestions for grocery shopping:

- Stay six feet from other shoppers.

- Don’t touch your face while shopping.

- Put your groceries away.

- Wipe anything you are using immediately with disinfectant. (Clean all grocery packages before you put them away, if it makes you more comfortable.)

- Wash your hands after putting groceries away.

- Wash fruits and vegetables before using.

So, how many hours is enough hours to wait? Allen explained the findings of an article in the New England Journal of Medicine. “…the virus’s half-life on stainless steel and plastic was 5.6 hours and 6.8 hours, respectively. (Half-life is how long it takes the viral concentration to decrease by half, then half of that half, and so on until it’s gone.)”

Finding Humor in a Time of Stress

In Time’s article, ‘Laughter Helps the Brain Relax. How Humor Can Combat Coronavirus Anxiety,’ William Kole offered some insights to the importance of humor:

“Neil Diamond posts a fireside rendition of ‘Sweet Caroline’ with its familiar lyrics tweaked to say, ‘Hands … washing hands.’ A news anchor asks when social distancing will end because ‘my husband keeps trying to get into the house.’ And, a sign outside a neighborhood church reads: ‘Had not planned on giving up quite this much for Lent.’ Are we allowed to chuckle yet? We’d better, psychologists and humorists say. Laughter can be the best medicine, they argue, so long as it’s within the bounds of good taste.”

When you’re feeling overwhelmed, it can help to spend some time with the work of your favorite comedian, satirist, or cartoonist.

Weekly Focus – Think About It

“Apparently there is nothing that cannot happen today.”

—Mark Twain, Humorist

Wishing you and your families well,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.popsci.com/story/health/united-states-covid-19-coronavirus-cases/

https://www.cdc.gov/coronavirus/2019-ncov/cases-updates/cases-in-us.html

https://www.dol.gov/ui/data.pdf

https://www.pewresearch.org/2010/12/14/reagans-recession/

https://www.appropriations.senate.gov/imo/media/doc/FINAL%20FINAL%20CARES%20ACT.pdf

https://www.barrons.com/articles/bear-market-rally-doesnt-mean-stocks-will-revive-quickly-51585358951?mod=hp_LEAD_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-30-20_Barrons-Bear-Market_Rally_Doesnt_Signal_Quick_Revival_for_Stocks-Footnote_8.pdf)

https://www.cnbc.com/2020/03/26/stock-market-futures-open-to-close-news.html

https://www.washingtonpost.com/opinions/2020/03/26/dont-panic-about-shopping-getting-delivery-or-accepting-packages/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-30-20_TheWashingtonPost-Dont_Panic_About_Shopping_Getting_Delivery_or_Accepting_Packages-Footnote_10.pdf)

https://time.com/5811041/laughter-humor-coronavirus/

https://www.brainyquote.com/quotes/mark_twain_122786

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe