March 10, 2020

How to Spot a Tax Scam

Taxpayers should know the signs of a phone scam, especially during filing season. Aggressive criminals sometimes pose as IRS agents in hopes of stealing money or personal information. These tips, courtesy of the IRS, should help keep you safer.

The IRS will never:

- Call to demand immediate payment using a specific payment method such as a prepaid debit card, gift card or wire transfer. Generally, the IRS will first mail a bill to any taxpayer who owes taxes.

- Threaten to immediately bring in local police or other law enforcement groups to have the taxpayer arrested for not paying.

- Demand that taxes be paid without giving taxpayers the opportunity to question or appeal the amount owed.

- Call out of the blue about an unexpected tax refund.

Taxpayers who receive these phone calls should:

- Hang up the phone immediately.

- Report the call to TIGTA using their IRS Impersonation Scam Reporting form or by calling 800-366-4484.

- Report the number to phishing@irs.gov and be sure to put ‘IRS Phone Scam’ in the subject line.

More information is available at IRS.gov:

Schedule Your Tax Prep Appointment

Filing your tax return promptly is another way to protect yourself, especially this year given the uncertainty around COVID-19. If you haven’t yet scheduled your appointment, please take a moment to call 203‑967‑2231 or email us.

The Markets

Last week, market volatility reached levels that make many investors uncomfortable.

On Monday, the Dow Jones Industrial Average surged higher, delivering its biggest one-day point gain in history. The catalyst may have been reports that ‘Group of Seven’ (G7) finance ministers and central bank governors were meeting via conference call on Tuesday. French Finance Minister Bruno Le Maire indicated the discussion would lead to coordinated monetary efforts to address economic issues related to the coronavirus, reported Reuters.

The G7 includes seven countries: United States, United Kingdom, Germany, Canada, Japan, France, and Italy. The European Union is a ‘non-enumerated’ member. The nations represent about 50 percent of the global economy, according to the Council of Foreign Relations, and was formed to coordinate global policy.

On Tuesday, the U.S. Federal Reserve (Fed) implemented a surprise rate cut. The pre-emptive move surprised many because the Fed’s policy-setting meeting was just two weeks away. The policy change sparked anxiety among investors. The Standard & Poor’s 500 Index, which had gained about 4.6 percent on Monday, dropped 2.8 percent on Tuesday, reported Ben Levisohn of Barron’s.

U.S. Treasury yields moved lower, too. The yield on 10-year U.S. Treasuries closed below 1 percent for the first time ever last week, reported Alexandra Scaggs of Barron’s.

On Friday, a robust employment report was largely ignored, reported Randall Forsyth of Barron’s, as were increases in the Atlanta Federal Reserve’s GDPNow estimate indicating economic growth during the first quarter may have been stronger than anticipated. Despite a downward swing on Friday, major U.S. stock indices finished the week higher.

Forsyth also reported Kenneth Rogoff, Professor of Economics and Public Policy at Harvard, is concerned the economic consequences of the coronavirus could include inflation. Production slowdowns and supply chain disruptions caused by the coronavirus could result in a mismatch between the supply of goods available and demand for goods across the globe.

In a Project-Syndicate commentary, Rogoff explained, “…the challenge posed by a supply-side-driven downturn is it can result in sharp declines in production and widespread bottlenecks. In that case, generalized shortages – something some countries have not seen since the gas lines of 1970s – could ultimately push inflation up, not down,” he contends.”

Until more is known about the coronavirus, markets may remain volatile.

When Are People the Gloomiest?

In 2005, a psychologist considered a variety of criteria – weather, debt levels, income, post-holiday mindset, New Year’s resolutions, motivation levels, and more – and decided the third Monday in January was the day people are gloomiest, reported the United Kingdom’s Medical News Today.

His efforts were part of a travel company marketing campaign encouraging people to book flights in order to combat the post-holiday blues.

Now, The Economist has carefully analyzed music consumption to “create a quantitative measure of seasonal misery.” The publication used data from a popular music streaming service that offers 50 million options to 270 million people in 70 plus countries to track the type of songs people around the world listened to each month from January 1, 2017 to January 29, 2020.

The Economist relied on the streaming company to determine the emotional scale of the songs played during any given month. It explained, “The firm has an algorithm that classifies a song’s “valence,” or how happy [a song] sounds, on a scale from 0 to 100. The algorithm is trained on ratings of positivity by musical experts and gives Aretha Franklin’s soaring “Respect” a score of 97; Radiohead’s gloomy “Creep” gets just 10.” The happier end of the valence spectrum also included:

- OutKast’s “Hey Ya!”

- Taylor Swift’s “Shake It Off”

- Luis Fonsi’s “Despacito”

The sadder end included:

- Adele’s “Make You Feel My Love”

- Simon & Garfunkel’s “Bridge Over Troubled Waters”

- Nina Simone’s “I Put A Spell On You”

When the results were tallied, the global top 200 songs for February were the gloomiest overall. If you were curious, people played the happiest songs during July, although there was a joyful spike in late December for Christmas.

Weekly Focus – Think About It

“The whole of life itself expresses the blues. That's why I always say the blues are the true facts of life expressed in words and song, inspiration, feeling, and understanding. The blues can be about anything pertaining to the facts of life. The blues call on God as much as a spiritual song do.”

—Willie Dixon, Blues musician

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

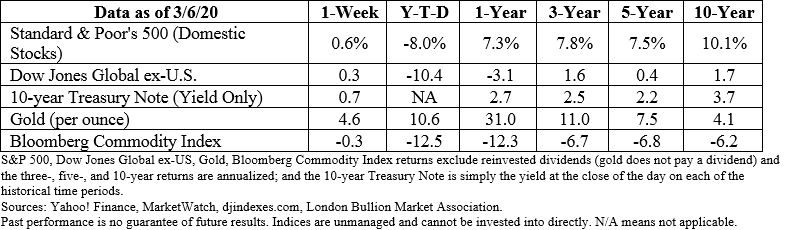

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Economic forecasts set forth may not develop as predicted and are subject to change. Investing involves risk including loss of principal.

- The Price-to-Earning (P/E) ratio is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher P/E ratio means investors are paying more for each unit of net income, thus, the stock is more expensive compared to one with a lower P/E ratio.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.cfr.org/backgrounder/g7-and-future-multilateralism

https://www.barrons.com/articles/dow-jones-industrial-average-finishes-week-higher-the-pain-isnt-over-51583548961?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-09-20_Barrons-The_Stock_Market_Finished_the_Week_Higher-The_Pain_Isnt_Over-Footonote_4.pdf)

https://www.barrons.com/articles/u-s-treasury-yields-plummet-past-0-8-for-the-first-time-51583501109 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-09-20_Barrons-US_Treasury_Yields_Keep_on_Plummeting-Footnote_5.pdf)

https://www.barrons.com/articles/the-rate-cut-drug-might-not-cure-ailing-market-51583545555?mod=hp_DAY_2 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-09-20_Barrons-The_Rate-Cut_Drug_Might_Not_Cure_Ailing_Market-Footnote_6.pdf)

https://www.medicalnewstoday.com/articles/324236#A-self-fulfilling-prophecy

https://www.economist.com/graphic-detail/2020/02/08/data-from-spotify-suggest-that-listeners-are-gloomiest-in-february (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/03-09-20_TheEconomist-Data_from_Spotify_Suggest_that_Listeners_are_Gloomiest_in_February-Footnote_9.pdf)

https://www.azquotes.com/quote/709869?ref=blues-music

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe