December 31, 2019

The SECURE Act Takes Effect Tomorrow, and It Probably Affects Your Retirement Plan

As noted last week, the SECURE Act was signed into law on December 20th and will take effect almost immediately—January 1, 2020. The new rules will almost certainly affect your retirement and legacy plan. Among other things, the SECURE Act makes major changes to Required Minimum Distributions on IRAs. Be sure to read this brief synopsis, and call 203‑967‑2231 or email us to discuss the ways we can adapt your personal financial strategies to the new law.

The Markets

2019 will be a hard act to follow.

Investors may find themselves reluctant to ring out the old and ring in the new this week. During 2019, stock and bond markets delivered exceptional returns.

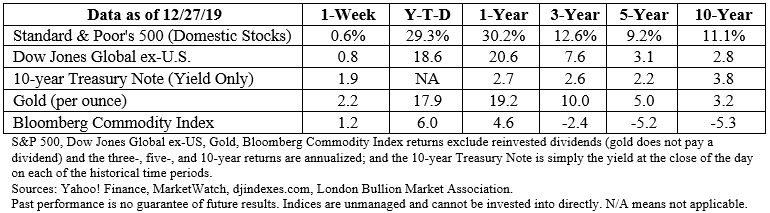

Ben Levisohn of Barron’s reported the Dow Jones Industrial Average was up 23 percent at the end of last week, the Standard & Poor’s (S&P) 500 Index had gained 29 percent, and the Nasdaq Composite was up 36 percent. The S&P 500 and Dow both closed at all-time highs.

Bond indices showed gains in the United States and around the world. The Bloomberg Barclays U.S. Aggregate Total Return Index was up 8.87 percent at the end of last week. Its global counterpart, the Bloomberg Barclays Global Aggregate Total Return Index, was up 6.63 percent for the same period.

After a year like 2019, when stock indices delivered exceptional returns, investors’ perceptions about their appetite for risk can change. Great market performance has a way of persuading people their tolerance for risk is higher than it has been in the past. The phenomenon has something to do with recency bias, which is a tendency to remember and weight recent events more heavily than past events.

In other words, during bull markets some people tend to forget about bear markets.

2019 was a wonderful year, but not every year will be like 2019. At the end of last week, the average annual return for the S&P 500 Index over the last 60 years, with dividends reinvested, was about 9.5 percent.

The fact that 2020 may not be like 2019 does not mean it’s time to sell. Successful financial plans and investment strategies should include well-diversified portfolios that are grounded in the investor’s life and financial goals. Every strategy and portfolio should be reviewed periodically and modified when goals have changed, a major life event has occurred, or the investor’s risk tolerance has changed.

If you would like to talk about your strategy and review your portfolio allocations, give us a call. We’d like to hear from you.

The Holidays Are Almost Over

Ahh, the season of good cheer and regifting is coming to an end. Before we head into 2020, the Ohio Department of Transportation deserves a holiday salute for promoting safe driving with holiday humor. About 130 highway message boards across the state offered communications like these:

- Life is fra-gee-lay. Drive safe.

- Stay to the right. Santa needs the left lane tonight.

- If your relatives make you drink, don’t drive.

- Can I refill your eggnog, Eddie? —Clark

- Deck the halls/ No phone calls/ Fa la la la la

- Drop the phone. We triple dog dare you.

Weekly Focus – Think About It

“I hope that in this year to come, you make mistakes.

Because if you are making mistakes, then you are making new things, trying new things, learning, living, pushing yourself, changing yourself, changing your world. You're doing things you've never done before, and, more importantly, you're doing something.

So that's my wish for you, and all of us, and my wish for myself. Make new mistakes. Make glorious, amazing mistakes. Make mistakes nobody's ever made before. Don't freeze, don't stop, don't worry that it isn't good enough, or it isn't perfect, whatever it is: art, or love, or work, or family, or life.

Whatever it is you're scared of doing, do it.

Make your mistakes, next year and forever.”

—Neil Gaiman, Author

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/dow-jones-industrial-average-closes-at-record-high-good-luck-next-year-51577491993?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_Barrons-The_Dow_is_Closing_Out_2019_with_a_Bang-Good_Luck_in_2020-Footnote_1.pdf)

https://www.bloomberg.com/quote/LBUSTRUU:IND (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_Bloomberg-US_Aggregate_Total_Return_Value_Unhedged_USD-Footnote_2.pdf)

https://www.bloomberg.com/quote/LEGATRUU:IND (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_Bloomberg-Global_Aggregate_Total_Return_Index_Value_Unhedged_USD-Footnote_3.pdf)

https://bucks.blogs.nytimes.com/2012/02/13/tomorrows-market-probably-wont-look-anything-like-today/

https://dqydj.com/sp-500-historical-return-calculator/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-30-19_DQYDJ-S_and_P_500_Historical_Return_Results-Footnote_5.pdf)

http://www.dot.state.oh.us/news/Pages/Christmas-2019-Messages.aspx

https://www.goodreads.com/quotes/tag/new-year

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe