December 10, 2019

Reminder: Make Your Appointment Now for Year-End Tax Planning

The holiday season is here! Make sure you take advantage of any money-saving tax strategies before the end of the year. Call 203‑967‑2231 or email us to make your appointment and find out which strategies are right for you.

The Markets

Ahh, the power of distraction.

On Friday, the unemployment report flashed its numbers like a hair model in a shampoo commercial. The Bureau of Labor Statistics reported 266,000 new jobs were created in November. That was better than expected even after deducting the 40,000-plus General Motors employees returning to work, reported CNBC.

The sign of economic strength helped major U.S. stock indices recover from losses suffered earlier in the week – mostly.

The week got off to a rough start when President Trump indicated there was little urgency to resolving the trade dispute with China. The statement upset expectations a phase one trade deal would be completed before December 15. That’s the date the United States is scheduled to put additional tariffs on Chinese consumer goods. New tariffs could inspire additional actions by the Chinese government that affect economic growth in the United States.

To date, U.S. economic growth has slowed from 3.1 percent in the first quarter of 2019 to 1.9 percent in the third quarter.

The slowdown was caused, in part, by Chinese tariffs on American products. Tariffs have had a negative effect on manufacturing and agriculture, as well as other sectors of the market. Trade uncertainty also has led to a decline in business investment. When business investment drops so does the economy’s growth potential. The main engine behind U.S. economic growth has been and remains the American people. Consumer spending accounted for 68 percent of U.S. economic growth in the third quarter.

The Standard & Poor’s 500 Index finished the week in positive territory. The Dow Jones Industrial Average and Nasdaq Composite finished down 0.1 percent.

The Evolving Etiquette of Social Media

Social media etiquette makes remembering when to use the little fork on the right – you know, the one next to the two knives and spoon (the oyster fork) – seem like a snap.

When social media platforms were gaining popularity, they offered an opportunity to reconnect and stay in touch with friends and family. During the past decade, many people joined platforms and built networks. They also started to engage in some unwelcome behaviors. Sometimes, social media is a place where people:

“…can say mean things without showing their face, discriminate with little consequence, and spill details nobody truly wants to hear,” explained Influence.co. “…it’s vital for people to remember that social media is meant to bring people together and that our online behavior can quickly come between us.”

To make it easier to understand which behaviors these are, the organization conducted a survey. The top digital dont’s included:

- Bullying others in comments (91.1 percent)

- Sharing discriminatory content (89.2 percent)

- Posting fake news (88.8 percent)

- Making passive-aggressive posts (78.5 percent)

- Oversharing personal details (77.4 percent)

- Complaining about a partner (75.8 percent)

- Giving medical advice (48.3 percent)

- Excessive hashtag use (33.8 percent)

It’s also a poor idea to post content about another person without their permission. One in 10 respondents had ended a friendship over it. Finally, many people find it irritating when asked to delay eating a meal so a dinner companion can photograph it.

It’s food for thought.

Weekly Focus – Think About It

“One of the big no-no’s in cyberspace is that you do not go into a social activity, a chat group, or something like that, and start advertising or selling things. This etiquette rule is an attempt to separate one's social life, which should be pure enjoyment and relaxation, from the pressures of work.”

—Judith Martin, a.k.a. Miss Manners, Etiquette authority

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

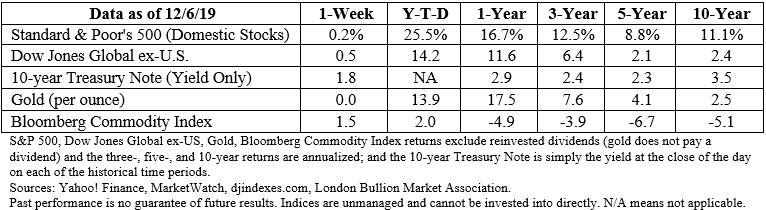

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.cnbc.com/2019/12/06/us-nonfarm-payrolls-november-2019.html

https://www.barrons.com/articles/dow-jones-industrial-average-ends-week-lower-despite-strong-jobs-report-51575684786?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/12-09-19_Barrons-The_Jobs_Numbers_were_Great-The_Dow_Still_Finished_Down_for_the_Week-Footnote_3.pdf)

https://apps.bea.gov/scb/2019/11-november/pdf/1119-gdp-economy.pdf

https://www.bea.gov/news/2019/gross-domestic-product-1st-quarter-2019-advance-estimate

https://fred.stlouisfed.org/series/W790RC1Q027SBEA

https://www3.nd.edu/~cwilber/econ504/504book/outln11b.html

https://emilypost.com/advice/formal-place-setting/

https://influence.co/go/content/social-media-etiquette.htm

https://www.brainyquote.com/quotes/judith_martin_581570?src=t_etiquette

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe