September 24, 2019

The Markets

They say bull markets climb a wall of worry.

Investopedia’s Will Kenton explained the idea like this:

“…a bull market isn’t a peaceful place. When times are good, investors are constantly tense, wondering how long they will keep rolling, fretting about when a seemingly inevitable correction will finally put a stop to the market elation. As a market continues ascending, the decision can become increasingly agonizing whether to take profits in a position or let it ride.”

Last week, the wall of worry gained a few feet.

The University of Michigan Surveys of Consumers indicated confidence improved in September, which appeared to be positive news. However, the report suggested positive sentiment is eroding. “More consumers reported unfavorable news about the economy in September than in eight years since September 2011. While a good share of the news involved tariffs and other economic policies, there were nearly as many reports on job losses as job gains.”

Reports the administration is considering ways to limit investment in China had investors concerned about possible portfolio repercussions. The steps being considered include regulating U.S. government pensions’ exposure to Chinese stocks, regulating stock indices’ allocations to Chinese holdings, and delisting Chinese shares from U.S. stock exchanges, reported Bloomberg.

The Federal Reserve’s daily liquidity injections into the repurchase agreement market, which underpins U.S. money markets, were a source of concern for some. The Economist reported, “Market-watchers blamed the cash crunch on firms’ need to pay corporate-tax bills at the same time as sucking up more new government debt than usual. But banks were aware of these factors well ahead of time. Other, as yet poorly understood, forces seemed to have provided the nudge that tipped repo markets into disarray.”

The announcement of a Presidential impeachment inquiry was big news that had a relatively small affect on U.S. stock markets last week.

Major U.S. stock indices finished the week lower.

Bee Friendly

When people travel, decisions about where to stay are determined by location, price, and amenities. One valued perk is loyalty points. While there is no official valuation assigned to reward points, estimates of value range from 0.3 cents to 1.6 cents per point, according to UpgradedPoints.com.

Hotels entice guests with other types of perks, too. These can be simple, like making forgotten toiletries available at no cost or having coffee makers and bottled water in rooms. As lodgings move up the luxury scale, amenities become more sublime. Some luxury hotels offer:

- All-you-can-eat ice cream

- In-room arcade games

- Yoga mats

- Designer bath salts

- Fragrance butlers

- Loaner Vespas

The latest hotel buzz is bees.

Hotels are hosting bee colonies. The Washington Post reported:

“The purpose of putting beehives atop the hotel is to support bee research and bring attention to a larger issue: the importance of pollinators and the threats they face…According to a 2016 Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services report, 75 percent of the world's food crops – including almonds, avocados, chocolate, and coffee – are dependent on pollination, and one of every three bites we eat is thanks to the work of pollinators.”

Some hotels collect the honey and infuse it into food, drinks, and skin care products for guests.

Weekly Focus – Think About It

“Having a superpower has nothing to do with the ability to fly or jump, or superhuman strength. The truest superpowers are the ones we all possess: willpower, integrity, and, most importantly, courage.”

—Jason Reynolds, American author and poet

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

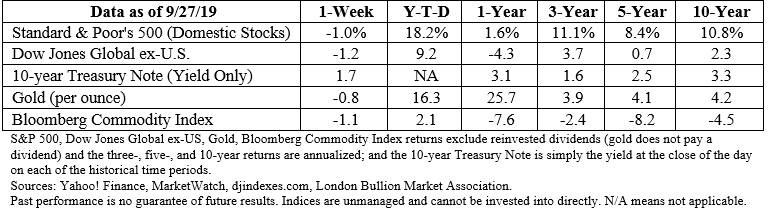

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.investopedia.com/terms/w/wallofworry.asp

https://news.umich.edu/u-m-surveys-of-consumers-confidence-rebounds/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-30-19_UnivMichigan-U-M_Surveys_of_Consumers-Confidence_Rebounds-Footnote_2.pdf)

https://www.economist.com/finance-and-economics/2019/09/26/repo-market-ructions-were-a-reminder-of-the-financial-crisis (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-30-19_TheEconomist-Repo-Market_Ructions_Were_a_Reminder_of_the_Financial_Crisis-Footnote_5.pdf)

https://finance.yahoo.com/news/stock-market-news-september-27-2019-121931896.html

https://upgradedpoints.com/points-and-miles-valuations/

https://www.rd.com/advice/travel/hotel-amenities/

https://www.gobankingrates.com/saving-money/hotels/things-hotel-give-free/

https://www.brainyquote.com/quotes/jason_reynolds_916018

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe