September 24, 2019

The Dowling Group Recognizes Greenwich Artists With Special Awards

The Dowling Group recently bestowed special awards upon two members of the Art Society of Old Greenwich. As noted in Greenwich Time:

…two member artists in the 2019 Art Society of Old Greenwich Sidewalk Art Show, which took place on September 14 and 15, received special awards given by the Dowling Group, a financial services company in Greenwich.

Carol Nipomnich Dixon won the Dowling Group Award for her embroidered collage, “Garden,” and Lucie Anderes won the J.M.Dowling CPA Award for her oil painting, “A Bridge at Tod’s Point.”

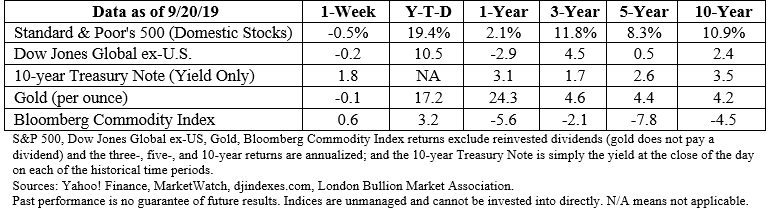

The Markets

There’s a new theory in town.

Renowned economist Robert Shiller’s new book suggests investors may be able to predict and prepare for economic events by tracking popular stories.

Applying the theory might have been a challenge last week. There were so many stories with potential to move markets and affect the economy it was difficult to guess which would be the most influential.

In the end, on-again-off-again trade negotiations provided the spark that drove markets lower. Barron’s explained:

“The S&P 500 would have finished flat for the week – except it decided to drop 0.5 percent after reports that China had canceled a visit to Montana hit the newswires…That’s not what we would have expected, given all of the week’s excitement. Saudi Arabia’s oil infrastructure was attacked. The Federal Reserve cut interest rates by a quarter-point. U.S. money markets went crazy and forced the Fed to intervene, setting off comparisons to the collapse of Lehman Brothers in 2008. And, yet, a Montana junket was the ultimate determinant of whether the market finished up or down.”

On Saturday, reports from U.S. trade representatives and China’s state-run news agency emphasized trade discussions were ‘constructive’ and ‘productive’ and would continue in October, reported The New York Times.

Last week, Federal Reserve Chair Jerome Powell mentioned trade wars 20 times in his news conference, reported The Wall Street Journal. “Other geopolitical risks figured less prominently or not at all. Mr. Powell mentioned Brexit once, and tensions in Hong Kong and Saudi Arabia didn’t come up.”

The Fed chair emphasized the Fed is using the tools at its disposal to support demand and counteract economic weakness. However, it has no way to resolve trade issues. He pointed out uncertainty about trade has reduced business investment across the United States and could hurt economic growth.

Until an agreement is reached, stories told about U.S.-China trade issues are likely to remain influential.

What’s Your Gig?

In a 2018 issue of the Harvard Business Review, an independent consultant compared working in the gig economy (a labor market characterized by the prevalence of short-term contracts or freelance work as opposed to permanent jobs) to being a trapeze artist. Independent work requires concentration and discipline. There is a stomach-dropping void between assignments and exhilaration when a new assignment is landed.

When you consider the risks of gig work, it’s remarkable so many people work independently. About 20 to 30 percent of the working population in the United States and Western Europe are gig workers, according to the McKinsey Global Institute.

People work independently for a variety of reasons. Forty-four percent derive their primary income from gig work (although 14 percent of these people would prefer traditional employment). Fifty-six percent earn supplemental income from independent work (16 percent of these people are financially strapped).

The most popular gigs, according to appjobs, are:

- Delivery work

- Freelance work (editing, translating, photography, art, copywriting, design, and consulting)

- Pet sitting

- Cleaning

- Driving

The most lucrative gigs include:

- Massage therapy

- Freelance work

- Home cooking

- Teaching

- Delivery work

The gig economy is growing. However, there are issues that make it less attractive, such as lack of benefits, income insecurity, and lack of training and credentialing. These issues may create opportunities for entrepreneurs.

Weekly Focus – Think About It

“You have brains in your head. You have feet in your shoes. You can steer yourself any direction you choose. You're on your own. And you know what you know. And YOU are the one who'll decide where to go…”

—Dr. Seuss, American children’s author

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/the-dow-jones-industrial-average-falls-for-week-despite-interest-rate-cut-51569026025?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-23-19_Barrons-The_Dow_Falls_as_Markets_Try_to_Figure_Out_What_Really_Matters-Footnote_2.pdf)

https://www.nytimes.com/2019/09/21/business/united-states-china-trade.html

https://www.wsj.com/articles/analysis-powells-subtle-messaging-to-trump-on-trade-fight-11568971800 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-23-19_WSJ-Analysis-Powells_Subtle_Messaging_to_Trump_on_Trade_Fight-Footnote_4.pdf)

https://hbr.org/2018/03/thriving-in-the-gig-economy

https://www.goodreads.com/quotes/22842-you-have-brains-in-your-head-you-have-feet-in

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe