September 10, 2019

The Markets

Remember the movie Groundhog Day?

Bill Murray’s character is a crotchety newsman who lives the same day over and over again. After exhausting other options, he chooses self-improvement and eventually escapes the cycle.

The movie came to mind last week when the United States and China headed to the negotiating table. Again.

Global stocks rallied on the news. Again.

The U.S.-China trade war has had a significant impact on stock market performance during the past two years. Since the trade war began, U.S. stock markets have rallied when trade talks are announced and retreated when trade talks fail. In 2018, MarketWatch reported:

“Trade issues have been at the center of Wall Street’s concerns because they have the potential to ripple into every other issue that has been besieging investors, if [the trade war] escalates. That includes the growth outlook for U.S. corporations, an economic slowdown in China, the pace of rate hikes, and the health of the U.S. economy and stock market…”

Last week, Fox News pointed out U.S. companies and consumers are feeling the effects of tariffs and that could be detrimental to U.S. economic growth, especially if consumer spending slows.

Regardless, major U.S. indices posted gains last week after the United States and China agreed to a new round of trade talks. Ben Levisohn of Barron’s explained:

“Why did the market soar? Not because of the economic data, which still paints the picture of a decelerating U.S. economy. August’s payrolls report came in light, and would have been even worse if not for a big boost from census hiring. The Institute for Supply Management’s manufacturing index fell below 50, signaling a full-blown contraction in industrial activity. But the United States and China finally set a date to go back to the bargaining table on trade – and that was more than enough good news to last the week.”

Maybe, this time around, trade talks will deliver a trade agreement.

If not, be prepared for more possible volatility.

Group Outings? Gift Requests? Let’s Talk Money Etiquette

If you’re of the generation that believes money is a taboo topic, stop reading. If you’ve encountered some perplexing money issues and want to learn more about money-related social etiquette, read on.

Issue: The bride and groom would prefer cash to gifts. Is it okay to request cash?

Answer: It is not okay to ask invited guests to give you cash, writes Carolyn Hax of The Washington Post. “There’s no polite way to bill guests for liking you, pat their pockets for loose change, or coerce them into paying your bills. So, please don’t try. Thank you.”

Issue: You’re organizing a group gift, outing, or trip. How do you avoid money conflicts?

Answer: BuzzFeed Finance recommends avoiding group texts, which “…are a breeding ground for peer pressure and anxiety. Suddenly, everyone agrees that $50 is a reasonable birthday amount, while one person had budgeted to spend around $20 and now feels too awkward to speak up. If you're the person organizing a joint gift, it's worth reaching out to people separately to gauge interest and a reasonable dollar amount.”

Issue: You’re raising money for several charities. How often can you ask the same person for a donation?

Answer: It depends, say the editors at Real Simple. It’s okay to approach immediate family for every cause, but limit requests to distant relatives, friends, and acquaintances to a couple of times a year. “You'll get better results – and keep more friends – by targeting your solicitations, rather than blasting your entire address book.”

Issue: Your girlfriend broke up with you on a peer-to-peer (P2P) payment app. All your friends saw it.

Answer: The default setting for most P2P payment apps is ‘public.’ As a result, people you know – and anyone else using the platform – can see who you paid, when you paid, and (sometimes) what you purchased. Consumer Reports suggests, “Make all your P2P settings the most private possible to ensure the least sharing of your personal data.”

When it comes to money, every generation faces unique challenges.

Weekly Focus – Think About It

“Etiquette is all human social behavior. If you're a hermit on a mountain, you don't have to worry about etiquette; if somebody comes up the mountain, then you've got a problem. It matters because we want to live in reasonably harmonious communities.”

—Judith Martin (a.k.a. Miss Manners)

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

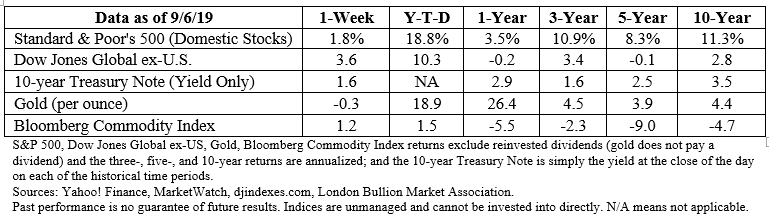

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.cnn.com/2019/09/06/business/us-china-trade-war-talks/index.html

https://www.foxbusiness.com/economy/us-china-trade-war-economy-recession-impact

https://www.barrons.com/articles/s-p-500-notches-second-week-of-gains-and-sets-itself-up-for-more-51567817597?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-09-19_Barrons-The_S_and_P_500_Finally_Busts_Out_and_Sets_Itself_Up_for_More_Gains-Footnote_4.pdf)

https://www.buzzfeed.com/gyanyankovich/money-etiquette-rules-for-2018

https://www.realsimple.com/work-life/money/money-etiquette-advice

https://www.consumerreports.org/digital-payments/p2p-payment-etiquette/

https://www.thespruce.com/quotes-about-good-manners-1216528

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe