September 3, 2019

The Markets

What, me worry?

About this time last year, Time Magazine reported on anxiety in America. Almost 40 percent of Americans reported being more anxious than they were the previous year.

The performance of stock and bond markets this summer may have pushed those numbers higher.

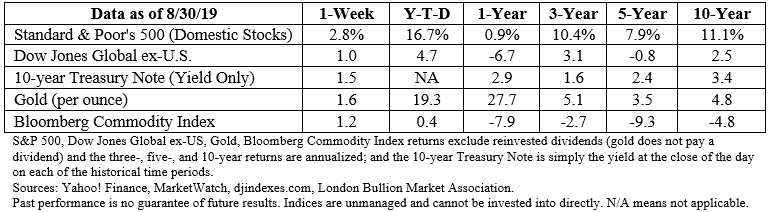

Last week finally brought some relief. It was the best week for major U.S. stock indices since June. The Standard & Poor’s 500 Index, Dow Jones Industrial Average, and Nasdaq Composite all gained between 2 and 3 percent, reported Ben Levisohn of Barron’s.

How can investors cope if volatility continues?

Barron’s Randall Forsyth offered a recommendation, “When the stock market is this crazy, you should just invest lazy.” It’s important to note that Forsyth’s definition of ‘managing lazy’ is building a diversified portfolio aimed at achieving your financial goals and leaving it alone.

Marketplace’s Andie Corban and Kai Ryssdal offered a pretty good argument for lazy investing, too. In the audio report, Ryssdal discussed trading algorithms with Joe Gits of Social Market Analytics:

“Gits: So these [algorithms] are reading the president’s tweet using natural language processing [NLP], and our current president’s tweets are pretty easy to read with NLP, and they are either going long or going short.

Ryssdal: I’m going to ask you to make a value judgment here, then. Entirely apart from making money, are these algorithms – and the outsized effect that they have on movement of the markets – are they a good thing or a bad thing?

Gits: I think they’re a bad thing in general, because I think the volatility causes a lot of panic by buying and selling and I think the average investor gets hurt.”

Staying calm in the face of volatility isn’t easy, but it’s an important skill for investors to hone. If it helps, remember volatility can be computer-driven.

Imagine Money With An Expiration Date

At the turn of the 19th century, some economists thought negative interest rates made sense, according to The Economist.

In 1916, Silvio Gesell published The Natural Economic Order, a pamphlet promoting the idea of negative interest rates. A self-taught economist, Gesell lost faith in money after living through a financial crash in Argentina during the 1890s.

Planet Money reported:

“The problem, Gesell believed, was that money served two roles that often came into conflict: It was a way for people to store wealth, and it was the thing everybody needed to conduct business. The fact that money could store wealth meant its holders had a reason to cling to it, especially in crises like the one he saw in Argentina, when opportunities to safely put that money elsewhere looked grim. It was a typical story. When people got scared, they hoarded cash and brought business to a standstill.”

Gesell suggested a solution: negative interest rates on money. If money continuously lost value, people would not hoard it. They would, in fact, have an incentive to spend it.

How do you make money lose value?

Gesell proposed a tax. Every year, money would expire and lose all value unless the money holder purchased a stamp. The stamp wouldn’t be free, reported Financial Times. There would be a fee for the stamp.

For example, if a person held a $100 bill and paid a $1 fee after holding it for a year, the after-stamp value of the money would be $99. After five years of paying fees, $100 would be worth $95.

Gesell believed people would, in effect, earn negative interest rates if they held onto money. As a result, they would be eager to spend, and that would keep the economy healthy, and possibly help prevent future depressions and improve prosperity.

It’s a thought-provoking theory that earned Gesell a number of nicknames, some flattering and some not.

Weekly Focus – Think About It

“The ultimate purpose of economics, of course, is to understand and promote the enhancement of well-being.”

—Ben Bernanke, Former Chair U.S. Federal Reserve

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://time.com/5269371/americans-anxiety-poll/

https://www.barrons.com/articles/stocks-rally-3-ending-a-bad-month-on-a-good-note-51567212639?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-03-19_Barrons-Stocks_Rally_3_Percent_Ending_a_Bad_Month_on_a_Good_Note-Footnote_2.pdf)

https://www.barrons.com/articles/when-the-stock-market-is-this-crazy-you-should-just-invest-lazy-51567213413?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-03-19_Barrons-When_the_Stock_Market_is_This_Crazy_You_Should_Just_Invest_Lazy-Footnote_3.pdf)

https://www.npr.org/sections/money/2019/08/27/754323652/the-strange-unduly-neglected-prophet (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-03-19_NPR-Planet_Money-The_Strange_Unduly_Neglected_Prophet-Footnote_5.pdf)

https://www.economist.com/finance-and-economics/2018/02/03/why-sub-zero-interest-rates-are-neither-unfair-nor-unnatural (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-03-19_TheEconomist-Why_Sub-Zero_Interest_Rates_are_Neither_Unfair_Nor_Unnatural-Footnote_6.pdf)

http://ftalphaville.ft.com/2015/02/02/2103032/negative-rates-and-gesell-taxes-how-low-are-we-talking-here/ (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/09-03-19_FinancialTimes-Negative_Rates_and_Gesell_Taxes-How_Low_are_We_Talking_Here-Footnote_7.pdf)

https://www.brainyquote.com/quotes/ben_bernanke_704771

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe