July 2, 2019

Photos from ‘Swim Across America’

Were you or someone you know at Swim Across America: Fairfield County? Photos have now been posted to SAA’s Flickr page. The Dowling Group was proud to be part of the fundraising effort, which has raised over $350,000 for the Alliance for Cancer Gene Therapy. Since 2007, SAA Fairfield County has donated over $3.8 million to ACGT, all of which has gone directly to research.

Get Ready for ‘Swing Fore Hope’

The Dowling Group is proud to sponsor the ‘Swing Fore Hope’ women’s golf tournament. The tournament will be held at 1:30pm July 18th at the Griffith E. Harris golf course. Beneficiaries of the event include Kids In Crisis and The Undies Project.

Kids in Crisis is Connecticut’s only free, round-the-clock agency providing emergency shelter, crisis counseling and community educational programs for children of all ages and families dealing with a wide range of crises, including domestic violence, mental health and family problems, substance abuse, economic difficulties and more. Over 132,000 families and children have been helped by Kids in Crisis through crisis counseling services, temporary shelter and prevention programs provided throughout the area.

The Undies Project was created in 2014 by Lucy Langley. While she sorted clothes for distribution she realized that underwear was the most under-donated and most needed item of clothing. She couldn’t imagine what it would be like to go without this necessity, or having to make the choice between putting a meal on the table or buying new underwear.

If you or someone you know would like to participate in the tournament or support these worthwhile charities, please contact us by calling 203‑967‑2231 or emailing us to learn how you can help.

The Markets

In the infamous words of Mortimer Snerd, “Who’d a thunk it?”

After U.S. stocks dropped sharply during the last weeks of December 2018, investors were not optimistic about the future. Early in January 2019, the State Street Investor Confidence Index dropped to its lowest point since 2012, and the American Association of Individual Investors (AAII) Sentiment Survey showed just about 31.6 percent of investors as bullish. The long-term average for bullishness is 38.2 percent.

How things have changed!

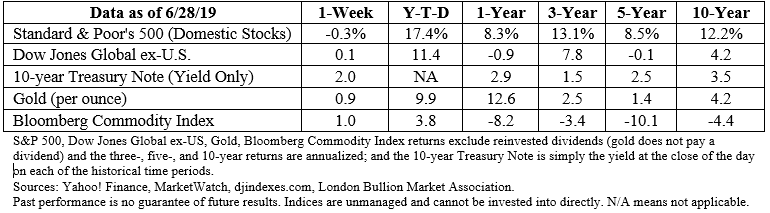

The Standard & Poor’s 500 Index finished the second quarter up about 17 percent year-to-date, according to Ben Levisohn of Barron’s. The index gained 6.9 percent in June, its best performance since 1955.

Stocks weren’t the only market delivering gains. Bond markets did well, too. Corrie Driebusch of The Wall Street Journal reported the yield on 10-year Treasuries finished the quarter at 2 percent. That was significantly below its yield at the end of March 2019. Remember, when bond yields fall, bond prices rise.

The strong performance of both markets owes much to changing policies at the Federal Reserve. Randall Forsyth of Barron’s reported,

“The first half of 2019 was terrific for financial markets, regardless of whether you were a stock or bond investor…a good first six months largely reflects the pivot by the Federal Reserve from its stance last year, when it indicated that it would raise short-term rates multiple times. In early January, Fed Chairman Jerome Powell said the central bank would be “patient” in boosting rates and then, in late spring, shifted to indicate that the next move is likely to be a cut.”

Stocks didn’t follow a steady upward trajectory during the second quarter, reported Forbes. Signs the U.S. economy could be softening combined with trade tensions between the United States and China caused major U.S. indices to lose ground in May before climbing higher again in June.

On Saturday, following the G20 Summit – a confab between leaders of 19 countries and the European Union, as well as representatives from the International Monetary Fund, and the World Bank – China and the United States agreed to restart trade talks, reported Reuters. President Trump indicated current tariffs on China will remain in place, but additional tariffs will not be assessed, according to CBS News.

While it appears to be positive news, managing director of the International Monetary Fund Christine Lagarde stated, “While the resumption of trade talks between the United States and China is welcome, tariffs already implemented are holding back the global economy, and unresolved issues carry a great deal of uncertainty about the future,”

Last week, the S&P 500 was down slightly, as were yields on 10-year Treasuries.

Hold onto your hats. We could see some volatility during the second half of the year.

Confused About Tariffs?

The United States and China have resumed trade talks, but it could be a while before things settle – and all tariffs may not be removed even if talks are successful. Since, there is a lot of misinformation floating around about tariffs, we want to review the basics.

When the United States puts tariffs on Chinese goods, China does not pay the tariff. American companies that import goods from China pay the tariffs. These companies may absorb the cost or pass the cost on to consumers by raising prices.

In some cases, manufacturers of complementary goods have raised the prices on items which aren’t subject to tariffs. (Complementary goods are products typically sold together like flashlights and batteries, printers and ink cartridges, or washers and dryers.)

Greg Rosalsky of Planet Money reported on tariff research from the Becker Friedman Institute for Economics at The University of Chicago reported the phenomenon. Rosalsky wrote,

“In early 2018…the Trump administration implemented tariffs on washing machines imported from all over the world. It's a 20 percent tariff on the first 1.2 million washing machines sold a year and a 50 percent tariff on every one after that…New washing machines in America got about 12 percent more expensive…dryers also got more expensive even though they weren't subject to the tariff. That's because washers and dryers…are typically bought at the same time...so the full effect of tariffs on prices is only visible after factoring in the price of the complementary good – dryers."

When it happens in reverse and China puts tariffs on the United States, the United States does not pay the tariff. Chinese companies importing the goods from the United States pay the tariff, and which may cause Chinese companies to buy goods from countries that are not assessed tariffs. Reuters reported,

“American farmers have been among the hardest hit so far. China is the top market for many of their biggest crops and Beijing hit those crops with retaliatory tariffs…The single biggest agricultural export from the United States are soybean sales, most of which went to China before the trade war.”

So, when you boil it down, American companies and consumers are paying U.S. tariffs on Chinese goods. Chinese companies and consumers are paying Chinese tariffs on U.S. goods. Companies in both nations may be looking for alternative suppliers so they can keep prices low.

Weekly Focus – Think About It

“To argue against the global economy is like stating opposition to the weather - it continues whether you like it or not.”

—John McCain, American politician

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

http://snarkygrammarguide.blogspot.com/2012/09/thought-vs-thunk-irregular-or-ignorant.html

http://www.statestreet.com/content/dam/statestreet/documents/ici/ICI_HistData_Eng_Jun19.pdf

https://www.aaii.com/sentimentsurvey [or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/7-01-19_AAII_Sentiment_Survey_data.pdf provide e-mail address to read more. Click on download historic data at bottom of the page.]

https://www.barrons.com/articles/the-s-p-500-just-had-its-best-june-since-1955-51561767202?mod=hp_DAY_4 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/7-01-19_The_S%26P_500_Just_Had_its_Best_June_Since_1955.pdf)

https://www.wsj.com/articles/asian-stocks-slip-as-g-20-begins-11561708211 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/7-01-19_S%26P_500_Posts_Best_First_Half_in_22_Years.pdf)

https://www.investopedia.com/terms/b/bond-yield.asp

https://www.barrons.com/articles/whats-ahead-for-stocks-after-a-great-first-half-51561766305?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/7-01-19_What's_Ahead_for_Stocks_After_A_Great_First+Half.pdf)

https://www.forbes.com/sites/jjkinahan/2019/06/28/stocks-hit-positive-streak-in-june/#2170d0b864ce/

https://g20.org/en/summit/about/

https://www.brainyquote.com/topics/global_economy

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe