June 18, 2019

The Markets

Are we on the cusp of change?

The United States is doing quite well. Randall Forsyth of Barron’s reported:

“…the U.S. economy and stock market both seem to be doing better than OK, thank you, as the expansion and bull market celebrate their 10th anniversaries. Unemployment is around the lowest level in a half-century. The worst thing seems to be that inflation continues to run slightly below the Fed’s 2 percent target, a problem that might strike some as similar to being too rich or too thin.”

The economic facts are encouraging, but recent events have potential to knock the U.S. economy off its tracks. The most significant threat may be a second round of oil tanker explosions in the Gulf of Oman. The U.S. accused Iran and Iran denied responsibility, reported The Economist. Tensions in the region are on the rise.

U.S.-China trade rhetoric heated up, too, which has some analysts concerned. It’s difficult to discern what’s truly happening, though. Reuters reported the United States stopped the World Trade Organization investigation of China’s treatment of intellectual property in early June. Some believe the action signaled a thaw in trade relations.

This week new concerns may rise to the fore. The Federal Reserve’s Open Market Committee meets Tuesday and Wednesday. Some hope it will decide to lower rates, while others believe a rate cut is unnecessary.

Major U.S. stock indices gained value last week, despite a spate of bad news, but change may be coming.

Plastic Goes Where Few Have Gone Before

In 2012, filmmaker James Cameron brought attention to the Mariana Trench, the deepest point on Earth (6.8 miles down), when he took a solo dive into its depths. The seafloor of the abyss also has been visited by at least one plastic bag, according to the Deep Sea Debris Database on ScienceDirect.

The Mariana Trench is just one of many unlikely places where plastic has been found. Jesse Li of Axios reported, “A marine biologist found 373,000 toothbrushes and 975,000 shoes on the beaches of a remote string of islands in the Indian Ocean.” In addition, the manmade material has made the trip to Point Nemo, the most remote location on Earth. Point Nemo is more than 1,000 miles from civilization in every direction – the farthest a person can get from dry land without heading into space, according to Atlas Obscura.

The pervasiveness of plastic is not too surprising. There is a lot of it in the world. Globally, almost 400 million tons of plastic were produced in 2015. Fifty-five percent of it was discarded, 25 percent was incinerated, and 20 percent was recycled, according to Our World in Data.

The glut of plastic pollution inspired Canada to ban single-use plastics last week. The goal is to eliminate use by 2021. The European Union has taken similar steps. As plastic use ebbs, new packaging materials are being developed. Biodegradable seaweed bubbles may replace plastic water bottles. Paper made from stone may wrap food products and fresh fruit may arrive to market wrapped in palm leaves.

Innovation creates opportunities for investors.

Weekly Focus – Think About It

“Growth for the sake of growth is the ideology of the cancer cell.”

—Edward Abbey, American author and essayist

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

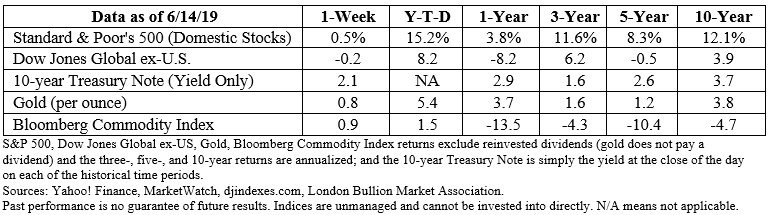

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/the-rate-cut-the-economy-doesnt-need-but-the-markets-do-51560557553?mod=hp_DAY_1 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-17-19_Barrons-The_Rate_Cut_the_Economy_Doesnt_Need_but_the_Markets_Do-Footnote_1.pdf)

https://www.economist.com/middle-east-and-africa/2019/06/13/who-is-blowing-up-ships-in-the-gulf (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-17-19_TheEconomist-Who_is_Blowing_Up_Ships_in_the_Gulf-Footnote_2.pdf)

https://www.barrons.com/articles/dow-jones-industrial-average-gains-as-interest-rate-decision-looms-51560555002?mod=hp_DAY_3 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-17-19_Barrons-The_Dow_Gains_Again_as_a_Decision_Looms_for_the_Federal_Reserve-Footnote_4.pdf)

https://www.sciencedirect.com/science/article/pii/S0308597X17305195

https://www.axios.com/plastics-places-found-608053d3-eb2d-4fc3-9ffc-8c66eda65ed6.html

https://www.atlasobscura.com/places/point-nemo

https://ourworldindata.org/plastic-pollution

https://www.nationalgeographic.com/environment/2019/06/canada-single-use-plastics-ban-2021/

https://www.innovationexcellence.com/blog/2018/07/02/13-plastic-packaging-alternatives/

https://www.goodreads.com/quotes/21664-growth-for-the-sake-of-growth-is-the-ideology-of

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe