June 4, 2019

The Markets

Tariff trouble.

Just two weeks ago, the U.S. government lifted tariffs on Mexico and Canada. So, it was a surprise last week when President Trump tweeted the United States would impose an escalating tariff on all goods imported from Mexico until the flow of migrants to the United States’ southern border stops.

The pending tariffs have potential to hurt both American and Mexican economies, reported The Economist. “Two-thirds of American imports from Mexico are between related parties, where one partner owns at least 10 percent of the other, so any tariff will cause problems along tightly integrated supply chains.”

In 2018, Mexico was the second largest supplier of imported goods to the United States. It provided 13.6 percent of U.S. imports. In addition, Mexico was the second largest importer of U.S. goods. The country took in 15.9 percent of overall U.S. exports, including machinery, electrical machinery, mineral fuels, vehicles, and plastics, according to the Office of the United States Trade Representative.

The new tariffs (a.k.a. import taxes) may increase costs for ordinary Americans. Last week, Liberty Street Economics explained the costs associated with Chinese tariffs:

“U.S. purchasers of imports from China must now pay the import tax in addition to the base price. Thus, if a firm (or consumer) is importing goods for $100 a unit from China, a 10 percent tariff will cause the domestic price to rise to $110 per unit…it is not a true cost for the U.S. economy because the money is simply transferred from buyers of imports to government coffers and thus could, in principle, be rebated.”

A different type of cost occurs when companies find new suppliers. For example, a company that chooses not to pay tariffs can buy goods elsewhere. They might choose to pay a Vietnamese firm $109 for a product rather than pay a Chinese firm $110 ($100 plus a 10 percent tariff). In this situation, the consumer pays a higher price and there is no tariff revenue that could be rebated. This is called a deadweight loss.

In total, Liberty Street Economics estimated the cost of 2018 tariffs on Chinese goods at $419 a year for the typical household ($132 in deadweight loss). The tariffs imposed in 2019 are expected to cost $831 a year ($620 in deadweight loss).

Liberty Street Economics did not estimate the potential consumer cost of new tariffs on Mexico.

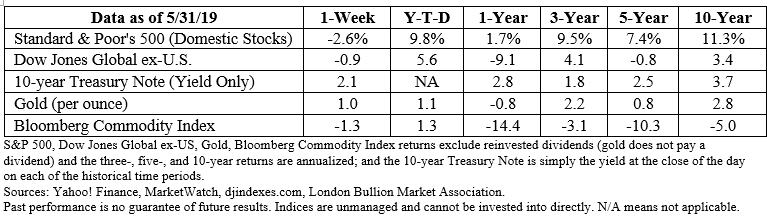

Major U.S. stock indices finished lower last week. Yields on U.S. Treasuries moved lower, too, suggesting investors may have been seeking safe havens.

Let’s Hear It For The Dogs

Some people love cats. Some people love dogs. Some people believe your preference offers insight to your personality. You have probably heard variations on this idea. WebMD offered the example that cat owners are open, curious, creative thinkers, while dog owners are outgoing, enthusiastic, self-disciplined planners.

Recently, a bit of data emerged that may please dog owners in Britain. It seems canines in the United Kingdom are outstanding personal trainers. A University of Liverpool study, published in April in Scientific Reports, found:

“The odds of [dog owners] meeting current physical activity guidelines of 150 minutes per week were four times greater than for [people who don’t own dogs]. Children with dogs reported more minutes of walking and free-time (unstructured) activity. Dog ownership is associated with more recreational walking and considerably greater odds of meeting [physical activity] guidelines…It is recommended that adults undertake at least 150 minutes of moderate-to-vigorous intensity physical (MVPA) activity per week.”

British dogs are better at ensuring their owners get enough exercise than American and Australian dogs. In both the United States and Australia, a significant number of dog owners reported their dogs live outside and exercise on their own.

Few cats are willing be leashed and taken for walks, so cat ownership is less likely to help owners meet physical activity goals. Regardless, cat owners may realize some health benefits. A University of Minnesota study found cat owners were 30 percent less likely to die from heart attacks or strokes than non-cat owners. It remains unclear whether cats help lower stress and anxiety or cat owners tend to have low-stress personalities.

Weekly Focus – Think About It

“Owners of dogs will have noticed that, if you provide them with food and water and shelter and affection, they will think you are god. Whereas owners of cats are compelled to realize that, if you provide them with food and water and shelter and affection, they draw the conclusion that they are gods.”

—Christopher Hitchens, Author and columnist

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://twitter.com/realdonaldtrump/status/1134240653926232064

https://www.economist.com/finance-and-economics/2019/05/31/donald-trump-vows-to-use-tariffs-to-punish-mexico-for-migrants (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-03-19_TheEconomist-Donald_Trump_Vows_to_Use_Tariffs_to_Punish_Mexico_for+Migrants-Footnote_3.pdf)

https://ustr.gov/countries-regions/americas/mexico

https://www.barrons.com/articles/dow-jones-industrial-average-drops-for-sixth-straight-week-on-tariff-tumult-51559351582?mod=hp_DAY_4 (or go to https://peakcontent.s3-us-west-2.amazonaws.com/+Peak+Commentary/06-03-19_Barrons-Dow_Drops_for_Sixth_Week_Because_Tariffs_Arent_Just_for_China_Anymore-Footnote_6.pdf)

https://pets.webmd.com/ss/slideshow-truth-about-cat-people-and-dog-people

https://www.nature.com/articles/s41598-019-41254-6

https://www.medicalnewstoday.com/articles/98432.php

https://www.goodreads.com/quotes/tag/pets

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe