May 21, 2019

The Markets

Trade war trade-off.

There was some good news on trade last week. The United States took steps to reduce trade friction with the European Union, Canada, Mexico, and Japan.

“The United States on Friday reached an agreement with Canada and Mexico to remove steel and aluminum tariffs, which had been a persistent source of friction across North America over the past year. The deal on metals came as Mr. Trump decided not to press ahead immediately with levies on EU and Japanese automotive products – despite declaring that foreign car and vehicle imports represented a threat to U.S. national security,” reported James Politi, Jude Webber, and Jim Brunsden of Financial Times.

There was some bad news, too. Trade tensions escalated between the United States and China. The United States doubled tariffs on $200 billion of Chinese goods and threatened tariffs on an additional $325 billion of goods. The United States imports about $539 billion worth of goods from China each year, reported the BBC.

In addition, President Trump signed an executive order preventing U.S. companies from using telecommunications equipment made by firms believed to pose a risk to national security. The move is expected to affect the ability of a large Chinese telecoms firm to conduct business in the United States, reported David Lawder and Susan Heavey of Reuters.

China currently has tariffs on $110 billion of American goods and they announced plans to hike tariffs on $60 billion of these goods. In total, China imports $120 billion worth of goods overall from the United States each year.

While the relatively small amount of American goods imported by China would seem to give the United States an advantage in a trade war, China has other means of gaining leverage. The country holds about 7 percent of U.S. debt, which is more than any other nation, reported Jeff Cox of CNBC. If China were to slow purchases of Treasuries, yields on U.S. government bonds may move higher.

A source cited by Reshma Kapadia of Barron’s suggested it is unlikely the Chinese will stop buying Treasuries. “Where would they put the trillions of dollars? Ten-year German Bunds are below Japanese 10-year yields; there aren’t a lot of options…They also don’t want their currency to appreciate, so that handcuffs them…China tends to find things to hurt adversaries without hurting themselves.”

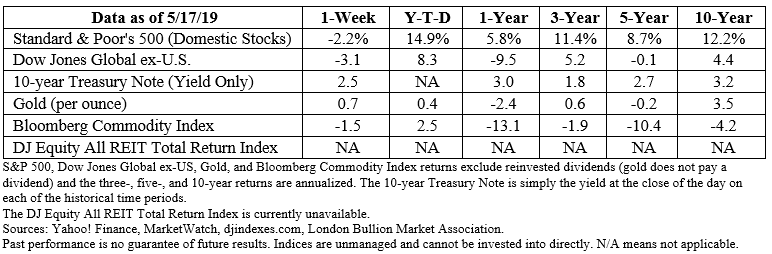

The Standard & Poor’s 500 Index finished the week lower.

Which Cities Offer The Best Quality Of Life?

In March, Mercer published its 21st Quality of Living Survey. The goal is to help multinational corporations with data that can help them optimize their global operations. The survey considers factors like safety, housing, recreation, economics, public transport, consumer goods, and more. For 2019, the cities offering the highest quality of life were:

- Vienna, Austria

- Zurich, Switzerland

- Vancouver, Canada

- Munich, Germany

- Auckland, New Zealand

- Düsseldorf, Germany

- Frankfurt, Germany

- Copenhagen, Denmark

- Geneva, Switzerland

- Basel, Switzerland

Thirteen of the world’s top-20 cities were in Europe. The safest cities in Europe were Luxembourg, Basel, Bern, Helsinki, and Zurich. The least safe, as far as personal safety goes, were Moscow and St. Petersburg.

In North America, Canadian cities generally did better than U.S. cities. The highest ranked city in the United States was San Francisco, which came in at 34th. Boston ranked 36th and Honolulu 37th. The safest cities in North America were Vancouver, Toronto, Montreal, Ottawa, and Calgary.

Dubai offers the best quality of life in the Middle East. Dubai and Abu Dhabi were the safest cities, while Damascus was the least safe – in the Middle East and the world.

Singapore, Tokyo, and Kobe had the highest quality of life rankings among Asian cities. Cities in Australia and New Zealand also did quite well, overall.

Weekly Focus – Think About It

“You are all there, the people in the city. I can't believe I was ever among you. When you are away from a city it becomes a fantasy. Any town, New York, Chicago, with its people, becomes improbable with distance. Just as I am improbable here, in Illinois, in a small town by a quiet lake. All of us improbable to one another because we are not present to one another.”

—Ray Bradbury, American author

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.ft.com/content/9aca49e0-78a3-11e9-be7d-6d846537acab (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/05-20-19_FinancialTimes-Donald_Trump_Eases_Tariffs_for_Allies_as_He_Focuses_on_China-Footnote_1.pdf)

https://www.bbc.com/news/business-45899310

https://www.barrons.com/articles/trade-war-stock-market-outlook-51558120641 (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/05-20-19_Barrons-The_Trade_War_Will_Make_Stocks_Scary-5_Reasons_Not_to_Panic-Footnote_5.pdf)

https://mobilityexchange.mercer.com/Insights/quality-of-living-rankings (Click on 2019 City Ranking, Show/Hide full ranking)

https://www.mercer.com/newsroom/2019-quality-of-living-survey.html

https://www.goodreads.com/quotes/tag/cities?page=6

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe