May 7, 2019

Tax Tip: Check On Your Refund and Verify Your Withholding Amount

Here are two particularly useful links to the IRS website:

- Where’s My Refund?: Instead of calling the IRS and waiting on hold, use this. It’s by far the best way to check on your refund status.

- Withholding Calculator: Even if little has changed in your own life, it’s prudent to see whether you need to adjust your paycheck withholding amount for the new tax year. It could help avoid or minimize an unexpected outcome in 2020.

As always, if you have questions about planning for taxes or any other financial matter, please give us a call at 203-967-2231.

The Markets

The Standard & Poor’s 500 Index is off to its best start in 20 years.

Despite the exceptional performance of U.S. stock markets year-to-date, and data that suggest economic growth remains steady, some analysts and investors have been pecking at Federal Reserve Chair Jerome Powell. They’re keen for the Fed to implement a rate cut, which could stimulate economic growth and help push stock markets higher, because inflation is lower than ideal, reported Howard Schneider and Ann Saphir of Reuters.

Recent data suggest core inflation is at 1.6 percent. That’s below the Fed’s target rate of 2 percent. Fed leaders have said they think low inflation may be temporary. Until a trend has been established to their satisfaction, they intend to do nothing. The Reuters article explained, “…preemptive…rate moves in either direction appear off the table for now, absent some unexpected event that raises new risks or shocks the economy into a higher or lower gear.”

Second-guessing the Fed is not new. In 1955, the ninth Chairman of the Federal Reserve, William McChesney Martin, offered this insight to the Fed’s work:

“Those who have the task of making [credit and monetary] policy don't expect you to applaud. The Federal Reserve…is in the position of the chaperone who has ordered the punch bowl removed just when the party was really warming up.”

On Friday, jobs data suggested U.S. economic growth continues apace. The Bureau of Labor Statistics report showed unemployment was at a 49-year low. The news made investors happy, and the Nasdaq Composite and S&P 500 finished the week higher.

Overlooked Economic Indicators

Last week, the Federal Reserve Open Market Committee statement indicated inflation was below target levels. The report stated, “On a 12-month basis, overall inflation and inflation for items other than food and energy have declined and are running below 2 percent.”

A less respected economic indicator is telling a similar story about inflation. The Tooth Fairy Index confirms the value of a baby tooth isn’t what it used to be. For the second consecutive year, the average monetary gift left behind by the Tooth Fairy was less generous. In 2018, it fell 43 cents to $3.70, on average.

There are regional differences. West Coast Tooth Fairies are, typically, more generous than Midwest tooth fairies. The regional numbers for 2018 looked like this:

- $4.19 was the average payout on the West Coast. That’s down 66 cents from $4.85 in 2017.

- $3.91 was the average payout in the South. That’s down 21 cents from $4.12 in 2017.

- $3.75 was the average payout in the Northeast. That’s down 60 cents from $4.35 in 2017.

- $2.97 was the average payout in the Midwest. That’s down 47 cents from $3.44 in 2017.

The first baby tooth lost continues to command a higher value than other teeth. It was worth $4.96, on average, across the country.

The non-monetary benefits of impending Tooth Fairy visits can be significant. They may include: 1) early bedtime in anticipation of the visit; 2) joy when compensated for a lost tooth; 3) a chance to discuss the importance of oral hygiene; and 4) the opportunity to teach kids about saving.

Weekly Focus – Think About It

“Joy, feeling one's own value, being appreciated and loved by others, feeling useful and capable of production are all factors of enormous value for the human soul.”

—Maria Montessori, Italian physician and educator

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

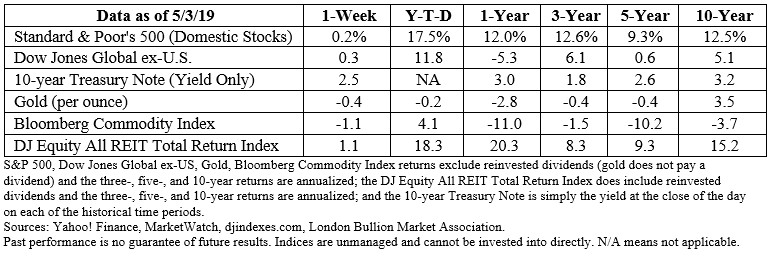

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/after-the-s-ps-hot-start-to-2019-risks-loom-larger-51556935408?mod=past_editions (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/05-06-19_Barrons-After_the_S_and_Ps_Hot_Start_to_2019_Risks_Loom_Larger-Footnote_1.pdf)

https://www.bls.gov/news.release/empsit.nr0.htm

https://www.theoriginaltoothfairypoll.com/news-release-parent/

https://www.brainyquote.com/quotes/maria_montessori_752858

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe