April 25, 2019

Tax Tip: Check On Your Refund and Verify Your Withholding Amount

Here are two particularly useful links to the IRS website:

- Where’s My Refund?: Instead of calling the IRS and waiting on hold, use this. It’s by far the best way to check on your refund status.

- Withholding Calculator: Even if little has changed in your own life, it’s prudent to see whether you need to adjust your paycheck withholding amount for the new tax year. It could help avoid or minimize an unexpected outcome in 2020.

As always, if you have questions about planning for taxes or any other financial matter, please give us a call at 203-967-2231.

The Markets

And the answer is…

A Jeopardy! contestant captured the nation’s attention last week by setting multiple records for the most money earned in a single episode. The Standard & Poor’s 500 Index has been setting some records, too.

Michael Mackenzie of Financial Times explained:

“Less than four months through the year, the S&P 500 including the reinvestment of dividends has returned to record territory, along with the technology sector…Around the world, many benchmarks enjoy double-digit gains, led by China’s CSI 300 index, having risen more than a third already during 2019.”

Pessimism about economic growth prospects has kept institutional investors – including professional money managers whose performance is typically evaluated quarterly – on the sidelines. As a result, despite a “market-friendly shift by central banks and an expansion in China’s credit growth that laid the ground for a rebound in activity,” they have missed out on some significant gains.

Financial Times suggested when institutional investors begin moving money into stock markets, we could see the market ‘melt up.’ A melt up occurs when valuations surge for reasons that have little to do with improving fundamentals and a lot to do with investors rushing into a market because they fear missing out on gains.

Investors seeking safe havens could temper any gains from institutional investors entering the market. Jack Hough of Barron’s suggested investors ignore safe havens, even though stock valuations remain high. He wrote, “…elevated prices don’t rule out more gains. The S&P 500 was this expensive at the end of 2016. It has returned 36 percent since.”

Some will take those words as encouragement, others as a warning. No matter which camp you are in, it may be a good time to have a carefully diversified portfolio.

What Do You Think?

A special item went up for sale on a popular online market, last week. It’s a 15-foot, 68 million-year-old skeleton of a juvenile Tyrannosaurus rex, according to The Washington Post. The ‘buy it now’ price is $2,950,000, which puts it beyond the budgets of most people, as well as many museums and universities.

The listing sparked lively debate.

The Society of Vertebrate Paleontology responded to the sale with a letter stating:

“The Society of Vertebrate Paleontology is concerned because the fossil, which represents a unique part of life’s past, may be lost from the public trust, and because its owner used the specimen’s scientific importance, including its exhibition status at [Kansas University], as part of his advertising strategy. These events undermine the scientific process for studying past life as well as the prospect for future generations to share the natural heritage of our planet.”

It’s a bit of a conundrum since many museums and universities rely on fossil hunters for specimens.

A paper in The Journal of Paleontological Sciences explained:

“The commercial fossil business has led to an abundance of paleontological discoveries and has resulted in that industry becoming a leader in museum fossil preparation, restoration, and mounts. This, in turn, has motivated many museum directors and trustees to turn to the fossil industry to acquire noteworthy and exciting specimens. This is often frugal and necessary especially when many museums do not have the staff or ability to mount collecting expeditions, create and house a preparation facility, or hire a fully trained and educated staff.”

The Washington Post interviewed the fossil hunter, who indicated, “…he has given scientists and the public ample access to the T. rex these past two years. Now, he contends, he deserves to be compensated. [The owner of the T-rex skeleton] has yet to receive an offer but says that he’s heard from prospects all over the world and that some people have even asked about shipping costs.”

Weekly Focus – Think About It

“It is better to debate a question without settling it than to settle a question without debating it.”

—Joseph Joubert, French philosopher and essayist

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

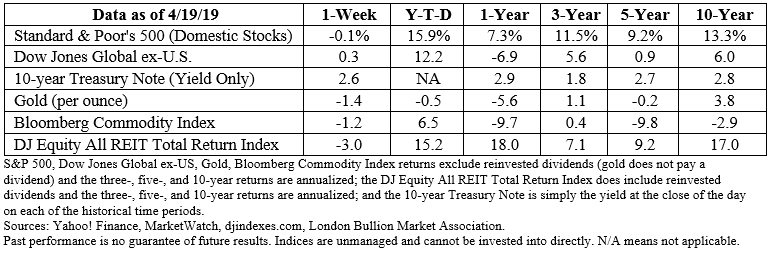

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.ft.com/content/6670a2b8-6113-11e9-b285-3acd5d43599e (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/04-22-19_FinancialTimes-Lure_of_Melt-Up_Trade_Leaves_Holdouts_in_Tough_Spot-Footnote_3.pdf)

https://www.investopedia.com/terms/m/melt-up.asp

https://www.barrons.com/articles/stocks-near-highs-defensive-havens-risk-missing-out-51555706775?mod=hp_DAY_2 (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/04-22-19_Barrons-As_Stocks_Near_Their_Highs_Resist_the_Call_of_These_Safe_Havens-Footnote_5.pdf)

https://www.washingtonpost.com/business/2019/04/19/you-can-buy-baby-t-rex-skeleton-ebay-million-scientists-would-rather-you-didnt/?utm_term=.6be279736124 (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/04-22-19_TheWashingtonPost-You_Can_Buy_a_Baby_T_Rex_Skeleton_for_3_Million_Dollars-Footnote_6.pdf)

http://vertpaleo.org/GlobalPDFS/SVP_response_juvenile_Tyrannosaurus.aspx

https://www.aaps-journal.org/Fossil-Dealer-Contributions.html

https://www.brainyquote.com/quotes/joseph_joubert_377081?src=t_debate

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe