April 9, 2019

Reminder: Schedule Your Tax Appointment

Tax Day is next Monday, April 15th. If you haven’t scheduled your appointment, please call today. Call 203‑967‑2231 or email advisors@thedowlinggroup.com to reserve your session. We look forward to seeing you!

The Markets

The first quarter of 2019 brought a welcome reversal.

Last year, Barron’s published a group of market strategists’ expectations for 2019 performance. The article came out in mid-December, before the steep year-end stock market decline. At that time, all of the strategists agreed: The S&P 500 Index would move higher during 2019.

Their expectations appeared to be wildly optimistic when the Index lost 3.5 percent during the last two weeks of 2018, and finished the year down 6.2 percent.

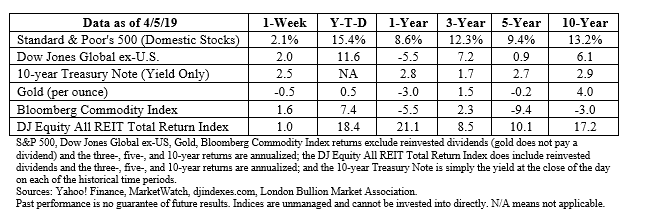

Overall, at the end of 2018, strategists expected the Index to reach 2,975 by year-end 2019. Despite starting 2019 at a lower level than many anticipated, the Index finished last week at 2,892, a gain of about 15.4 percent year-to-date, and 83 points from strategists’ full-year performance expectations.

While the U.S. stock market has delivered attractive returns year-to-date, suggesting investors anticipate strong economic growth ahead, the bond market has been telling a different story.

Late in the first quarter, the yield curve inverted, which means the yield on short-term Treasury bonds was higher than the yield on long-term Treasury bonds. Inverted yield curves are unusual because investors normally want to earn a higher yield when they lend their savings for longer periods of time.

In some cases, inverted yield curves have been a sign that recession is ahead. That may not be the case this time, reported Eva Szalay of Financial Times. It seems the extreme measures taken by central banks following the financial crisis may have undermined the yield curve’s predictive value:

“…according to a new piece of research from Pictet Wealth Management, the curve has been sending out misleading signals for a while. The distortions created by extraordinary post-crisis monetary policies have led to the breakdown in the relationship between interest rate expectations and economic growth, the firm argues…Since central banks have injected vast amounts of liquidity into their respective economies to compensate for lackluster growth, long-term interest rates have become artificially compressed…So the old rule no longer applies.”

The yield curve has since righted itself.

While recession may not be imminent, there are signs economies around the world are growing more slowly. Capital Economics reported, “World GDP [gross domestic product] growth seems to have slowed sharply in Q1, but the latest business surveys suggest that growth has bottomed out in some parts of the world at least…there are very few signs of improvement in the euro-zone and the United States has clearly been suffering from previous interest rate hikes and the fading fiscal boost. Those hoping for an imminent rebound in global growth are therefore likely to be disappointed.”

Slowing growth isn’t a sign recession is imminent in the United States. Last week’s jobs report suggests the American economy is still healthy, reported Tim Mullaney of MarketWatch, even if it is puttering along at a slower pace than many would like.

Exercise Is Important – Really Important – But Don’t Get Too Much

Researchers tested the relationship between mental health and exercise by collecting self-reported data from 1.2 million Americans. They discovered exercise – including everything from childcare and housework to weight lifting and running – can improve mental health.

Americans who were active tended to be happier and experienced poor mental health about 35 days a year. In contrast, those who remained inactive felt bad emotionally about 53 days a year, reported Entrepreneur.com. Exercising in a social setting – team sports, classes, and group cycling, for instance – appeared to deliver the biggest mental health benefits.

The study’s findings indicated it might be possible to exercise too much. “Exercising for 30-60 minutes was associated with the biggest reduction in poor mental health days…Small reductions were still seen for people who exercised more than 90 minutes a day, but exercising for more than three hours a day was associated with worse mental health than not exercising at all. The authors note that people doing extreme amounts of exercise might have obsessive characteristics which could place them at greater risk of poor mental health.”

If you’re not exercising regularly, you may want to find ways to include it in your day.

Weekly Focus – Think About It

“I have always tried to put my kids first, and then…put myself a really close second, as opposed to fifth or seventh. One thing that I've learned from male role models is that they don't hesitate to invest in themselves, with the view that, if I'm healthy and happy, I'm going to be a better support to my spouse and children. And I've found that to be the case: Once my kids were settled, the next thing I did was take care of my own health and sanity. And made sure that I was exercising and felt good about myself. I'd bring that energy to everything else that I did, the career, relationship, on and on and on.”

—Michelle Obama, Former First Lady of the United States

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indexes referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Stock investing involves risk including loss of principal.

- These views are those of Carson Group Coaching, and not the presenting Representative or the Representative’s Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Carson Group Coaching. Carson Group Coaching is not affiliated with the named broker/dealer.

- The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee it is accurate or complete.

- Consult your financial professional before making any investment decision.

Sources:

https://www.barrons.com/articles/u-s-stocks-could-rally-more-than-10-in-2019-51544837183 (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/04-08-19_Barrons-2019_Outlook-US_Stocks_Could_Rally_About_10_Percent-Footnote_1.pdf)

https://finance.yahoo.com/quote/^GSPC?p=^GSPC (Historical data)

https://www.macrotrends.net/2488/sp500-10-year-daily-chart

https://www.investopedia.com/terms/i/invertedyieldcurve.asp

https://www.ft.com/content/15d4048e-552f-11e9-91f9-b6515a54c5b1 (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/04-08-19_FinancialTimes-Why_the_Yield_Curve_is_Not_the_Economic_Guide_It_Once_Was-Footnote_6.pdf)

https://www.capitaleconomics.com/publications/global-economics/global-economics-chart-book/divergent-surveys-offer-limited-hope/ (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/04-08-19_CapitalEconomics-Global_Economics_Chart_Book-Footnote_7.pdf)

https://www.marketwatch.com/story/the-jobs-report-nails-it-its-a-slowdown-not-a-recession-2019-04-05

https://www.thelancet.com/journals/lanpsy/article/PIIS2215-0366(18)30227-X/fulltext

https://www.sciencedaily.com/releases/2018/08/180808193656.htm

https://www.entrepreneur.com/article/331696

https://www.sciencedirect.com/science/article/pii/S221503661830227X

https://www.glamour.com/story/michelle-obama

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe