September 11, 2017

Week in Review: 9/8/17

Commentary

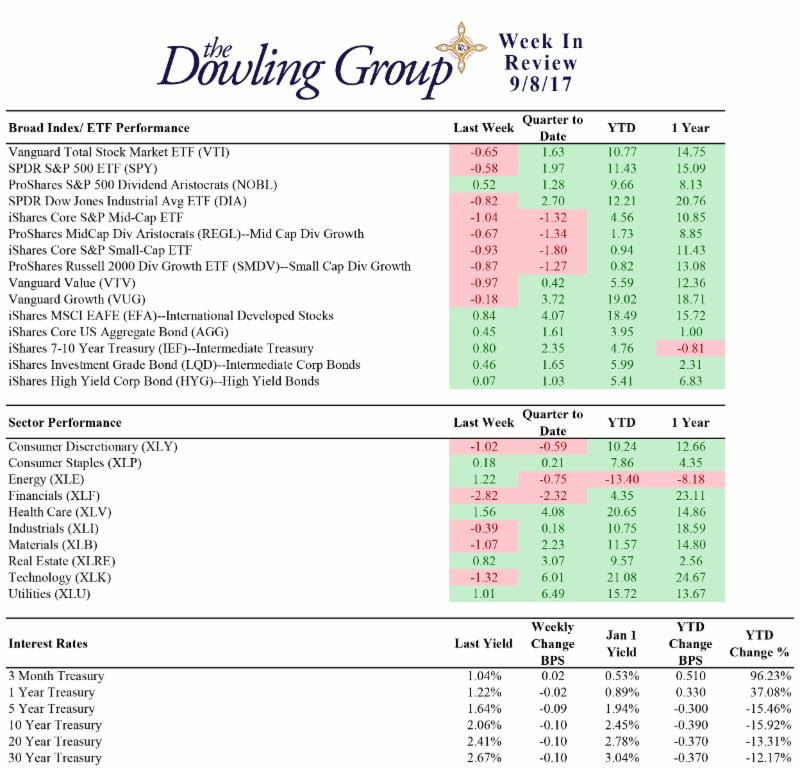

The major U.S. indices all moved lower last week as geopolitical tensions with North Korea, declining confidence in the feasibility of tax reform, and Hurricane Irma weighed on investor sentiment. The Nasdaq led the retreat, dropping 1.2%, while the Dow and the S&P 500 finished with respective losses of 0.9% and 0.6%.

Even though the equity market settled lower for the week, it remains within striking distance of its all-time high; the S&P 500 finished Friday's session just 0.8% below its record-high close of 2,480.91. Treasuries rallied this week, sending yields to new lows for the year. The benchmark 10-yr yield dropped 11 basis points to 2.06%, hitting its lowest level since early November.

Similarly, other safe-haven assets--like gold and the Japanese yen--moved higher, jumping 1.6% and 2.3%, respectively. The yellow metal settled at a 13-month high ($1,351.10/ozt) while the dollar/yen pair finished at a ten-month low (107.78). In addition, the CBOE Volatility Index (VIX) spiked 20.2% to 12.18. The financial sector (-2.8%) was pressured by the decline in Treasury yields, but most of the remaining groups finished with losses of no more than 1.1%.

Week In Review Stats

Open the weekly stats PDF here

Relative strength in heavyweight names like Home Depot (HD), Exxon Mobil (XOM), and Pfizer (PFE) prevented the stock market from a significant decline, but there were some soft spots in small-cap and high-beta pockets of the market. The small-cap Russell 2000--which is seen as a leading indicator given that small-cap companies largely rely on domestic consumers--underperformed, dropping 1.0%. After pacing the stock market's post-election rally, the small-cap index now holds a year-to-date gain of just 3.1%, far below the S&P 500's year-to-date advance of 9.9%.

High-beta chipmakers also struggled, sending the PHLX Semiconductor Index lower by 2.3%. Large-cap names like Qualcomm (QCOM) and NVIDIA (NVDA) showed particular weakness, settling with losses of 4.6% and 4.0%, respectively. Still, for the year, the PHLX Semiconductor Index is higher by 20.6%.

Following this week's events, the fed funds futures market places the chances of a December rate hike at 31.9%, down from last week's 43.7%.

Regards,

W. Joseph Ryan

Chief Investment Officer

The Dowling Group

Disclosures: This material represents The Dowling Group's views and opinions. These views may change without notice based on changing circumstance. The information provided should not be considered a recommendation to buy or sell any security, and should not be considered investment, legal, or tax advice. Information is obtained from sources believed to be credible and reliable, but its accuracy, completeness, and interpretation cannot be guaranteed.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe