August 22, 2017

Week in Review: 8/18/17

Commentary

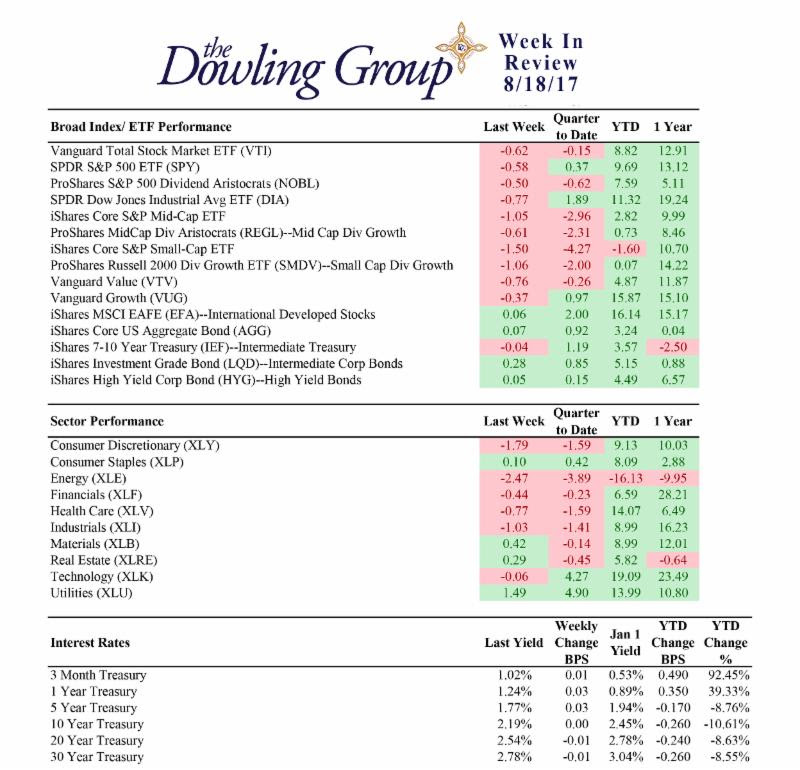

Wall Street had another disappointing week, its second in a row, as investors continued to drag the major U.S. indices from their all-time highs. The Dow, the S&P 500, and the Nasdaq finished with losses of 0.8%, 0.7%, and 0.6%, respectively, while the small-cap Russell 2000 underperformed (-1.2%), dropping to its flat line for the year.

Five sectors settled the week in the green–utilities (+1.3%), materials (+0.4%), real estate (+0.2%), consumer staples (+0.1%), and technology (unch)–while six groups finished in the red–energy (-2.7%), telecom services (-1.8%), consumer discretionary (-1.8%), industrials (-1.1%), health care (-0.8%), and financials (-0.5%).

The week's most notable headlines in chronological order:

Monday — S&P 500 +1.0%, Nasdaq +1.3%, Dow +0.6%

- Investors breathed a sigh of relief after a quiet weekend in regards to North Korea

Tuesday — S&P 500 -0.1%, Nasdaq -0.1%, Dow unch

- North Korea decided against executing last week's threat to launch missiles towards the U.S. territory of Guam

- July Retail Sales came in hotter than expected (+0.6% actual vs +0.3% Briefing.com consensus)

Wednesday — S&P 500 +0.1%, Nasdaq +0.2%, Dow +0.1%

- President Trump ended his Manufacturing Council and Strategy & Policy Forum following the departure of several CEOs

- The FOMC minutes from the July meeting showed concerns about softer than expected inflation readings

Thursday — S&P 500 -1.5%, Nasdaq -1.9%, Dow -1.2%

- Rumors that NEC Director Gary Cohn plans to resign circulated; the White House said the rumors are false

- Terrorist attacks in Spain killed 14 and left more than 100 injured

Friday — S&P 500 -0.2%, Nasdaq -0.1%, Dow -0.4%

- President Trump fired White House Chief Strategist Steve Bannon

- The SPDR S&P Retail ETF (XRT) settled at its worst level since February 2016 following this week's batch of earnings

Week In Review Stats

Open the weekly stats PDF here

Thursday's session was perhaps the most notable of the week as the S&P 500 registered its second-worst performance of the year. The major indices opened Thursday's session with modest losses, but moved deeper into negative territory following a rumor that President Trump's chief economic advisor Gary Cohn plans to resign from his position following the president's controversial comments regarding last weekend's events in Charlottesville, VA. The White House later declared that the rumor was "100% false", but it did little to reverse the market's downward trend.

True or not, the rumor didn't do much to dispel the notion that working with the president could be a political liability, especially considering that it came on the heels of Mr. Trump's Wednesday decision to disband his Manufacturing Council and Strategy & Policy Forum in response to several CEOs leaving the two groups. The chief executives cited Mr. Trump's controversial Charlottesville comments as the reason for their departures. If Republicans in Congress start distancing themselves from Mr. Trump, it will be that much harder for him to push through his pro-growth agenda.

However, those concerns eased a bit on Friday after President Trump fired White House Chief Strategist Steve Bannon, a decision that was well received by the market. Mr. Bannon was the chief executive of Mr. Trump's presidential campaign and has been described as perhaps the most polarizing figure within President Trump’s inner circle. Therefore, in the absence of Mr. Bannon, the thinking is that the president might dial back his rhetoric a bit, making it easier for the White House to work with Congress in passing the president's pro-growth agenda.

Following this week's events, the fed funds futures market now points to the March 2018 FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 51.5%. Last week, the market expected the next rate hike to occur in June 2018 with an implied probability of 57.5%.

Regards,

W. Joseph Ryan

Chief Investment Officer

The Dowling Group

Disclosures: This material represents The Dowling Group's views and opinions. These views may change without notice based on changing circumstance. The information provided should not be considered a recommendation to buy or sell any security, and should not be considered investment, legal, or tax advice. Information is obtained from sources believed to be credible and reliable, but its accuracy, completeness, and interpretation cannot be guaranteed.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe