August 7, 2017

Week in Review: 8/4/17

Commentary

According to the Dow Jones Industrial Average, the stock market had yet another bullish week; the industrial average ended Friday at a record high, for the eighth session in a row, and a weekly gain of 1.2%. However, the S&P 500 and the Nasdaq tell a less conclusive story; the S&P 500 muscled its way to a modest victory, adding 0.2%, while the Nasdaq dropped 0.4%.

Regardless of last week's mixed performance, there's no question that investors are still bullish as stocks hover near all-time highs and the CBOE Volatility Index (VIX) hovers near an all-time low.

The week's most notable headlines in chronological order:

- Crude oil settled July with its best one-month gain (+9.0%) since April 2016

- The core PCE Price Index for June hit expectations (+0.1%), as did personal spending (+0.1%), but personal income fell short (0.0% vs 0.3%)

- Sprint (S) spiked after beating earnings estimates, raising its profit guidance, and saying it believes an M&A announcement will come "in the near future"

- American automakers General Motors (GM) and Ford Motor (F) tumbled following disappointing July sales figures

- Apple (AAPL) jumped after beating both top and bottom line estimates and implying that its much-anticipated iPhone 8 release is on track

- Treasuries rallied after the Bank of England decided to leave interest rates unchanged in a 6-2 vote

- Tesla (TSLA) beat both top and bottom line estimates and announced that its Model 3 production is on track

- The Employment Situation Report for July soundly beat estimates, showing the addition of 209,000 nonfarm payrolls (consensus 181,000)

- However, average hourly earnings remained subdued, increasing just 0.3% (consensus +0.3%)

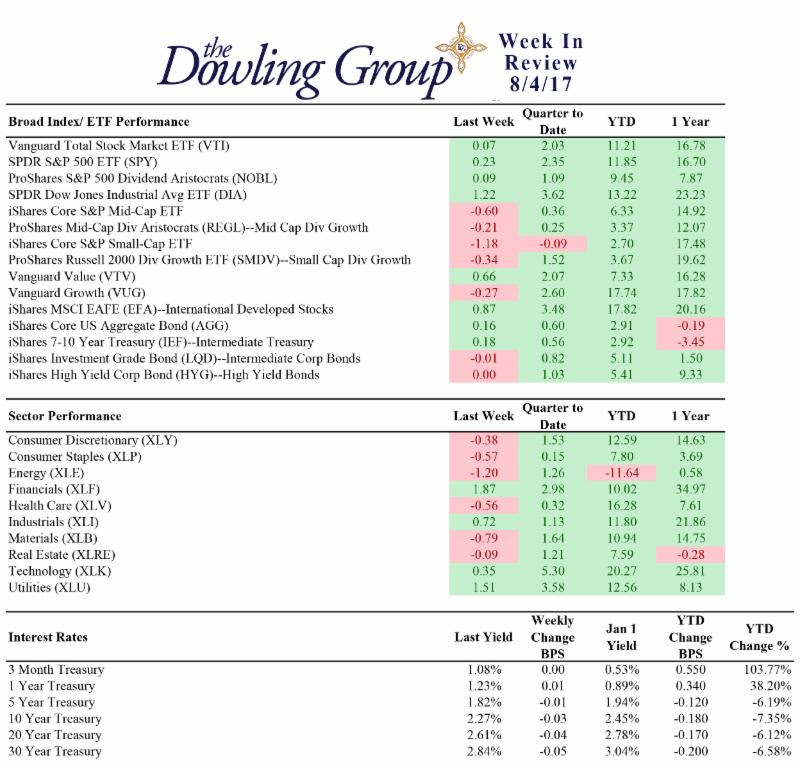

Week In Review Stats

Open the weekly stats PDF here

Of those headlines, two are worth a closer look—Apple's earnings report and the Employment Situation Report for July. Apple is the S&P 500's largest component by market cap and has played a huge role in the stock market's 2017 advance, evidenced by the massive 29.6% year-to-date gain it took into Tuesday night's earnings release.

Needless to say, it's quite impressive that the company was able to deliver in the face of such lofty expectations. However, it's also important to note that much of the positive sentiment surrounding the company has to do with its upcoming iPhone 8 release, which has been generating hype for months. So far, everything looks to be on track for the fall release, but if that changes, so might the bullish bias.

As for the July jobs report, the key take away is it hit the sweet spot once again as job growth was strong but wage growth was not, keeping inflationary concerns at bay. The fed funds futures market points to the December FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 50.4%. Last week, the market expected the next hike to occur in January.

Four sectors settled the week in the green—financials (+1.8%), utilities (+1.5%), industrials (+0.8%), and technology (+0.4%)—while seven groups finished in the red—energy (-1.0%), materials (-0.8%), health care (-0.6%), consumer staples (-0.6%), consumer discretionary (-0.4%), real estate (-0.2%), and telecom services (-0.1%).

Outside of the equity market, the benchmark 10-yr yield slipped three basis points to 2.26%, crude oil dropped 0.5% to $49.44/bbl, and the U.S. Dollar Index climbed 0.3% to 93.35.

Regards,

W. Joseph Ryan

Chief Investment Officer

The Dowling Group

Disclosures: This material represents The Dowling Group's views and opinions. These views may change without notice based on changing circumstance. The information provided should not be considered a recommendation to buy or sell any security, and should not be considered investment, legal, or tax advice. Information is obtained from sources believed to be credible and reliable, but its accuracy, completeness, and interpretation cannot be guaranteed.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe