January 3, 2018

How Good Was 2017?

2017 was so good, the Standard & Poor’s (S&P) 500 Index finished in positive territory every month for the first time ever (on a total return basis), reported Barron’s. All major U.S. indices finished the year with double-digit gains.

As we enter 2018, keep an eye on investor sentiment. “History has shown us that the crowd can be right during trends, but it also tends to be wrong at extremes. This is why sentiment can be an important contrarian indicator, because if everyone who might become bearish has already sold, only buyers are left. The reverse also applies,” reported ValueWalk.

Toward the end of 2017, sentiment shifted, but not everyone shared the same outlook. Surveys and indices that track market indicators and institutional advice became less bullish, while newsletter writers and investors became more bullish.

- The CNN Fear & Greed Index dropped from Greedy territory into the Neutral range. The Index measures seven indicators including stock price strength and breadth, market momentum, high-yield bond demand, and market volatility to determine the emotion that may be driving markets.

- The TIM Group Market Sentiment fell from 47.3 percent to 43 percent, becoming more bearish. TIM tracks actionable ideas sent from the sell-side (e.g., investment and commercial banks; stock brokers; market makers) to buy-side clients (e.g., asset managers; institutional and retail investors). A score of zero is the most bearish and 100 is the most bullish.

- The AAII Investor Sentiment Survey indicated individual investors are becoming more bullish and less bearish. Some believe the survey is a contrarian indicator:

- Bullish sentiment was up 2.1 percent to 52.6 percent. The long-term average is 38.5 percent.

- Neutral sentiment was up 2.8 percent to 26.7 percent. The long-term average is 31.0 percent.

- Bearish sentiment was down 5 percent to 20.6 percent. The long-term average is 30.5 percent.

During 2017, U.S. markets appeared to be Teflon-coated. Geopolitical events, natural disasters, and other shocks had little impact on investor optimism or share prices, and expectations for volatility remained historically low. That may continue during 2018, or it may not.

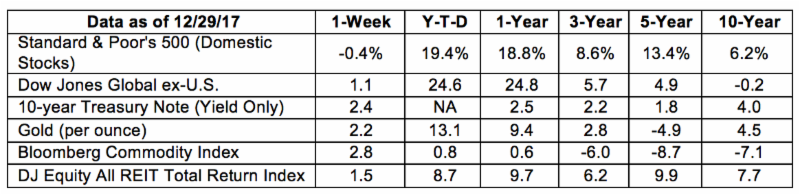

S&P 500, Dow Jones Global ex-US, Gold, Bloomberg Commodity Index returns exclude reinvested dividends (gold does not pay a dividend) and the three-, five-, and 10-year returns are annualized; the DJ Equity All REIT Total Return Index does include reinvested dividends and the three-, five-, and 10-year returns are annualized; and the 10-year Treasury Note is simply the yield at the close of the day on each of the historical time periods.

Sources: Yahoo! Finance, Barron’s, djindexes.com, London Bullion Market Association.

Past performance is no guarantee of future results. Indices are unmanaged and cannot be invested into directly. N/A means not applicable.

Best and Worst of 2017

It may have seemed longer but 2017 had 365 days, just like every other year. It was a year of firsts, worsts, and bests, although not everyone agrees about which were which. Here are a few memorable pop culture moments from 2017:

- Making a mistake. “At February’s Oscars, some [person] hands presenters Warren Beatty and Faye Dunaway the wrong envelope, leading to an incorrect announcement of Best Picture. The actual winner turns out to be whatever other accounting companies are vying for the academy’s business,” reported New York Post.

- Seeing and hearing the children. An interview with South Korea expert, Professor Robert Kelly, was interrupted by his toddlers and became a viral sensation. One Twitter post read, “Live your life like you just burst through the door of your dad’s super important live broadcast Skype call,” reported The Independent.

- Empowering women. “Wonder Woman became the best-reviewed DC Universe film and a box-office hero when it hit theaters in May…[It] had the biggest opening ever for a movie directed by a woman with a $100.5 million debut and presented a turning point for female representation on the big screen,” wrote USA Today.

- Selling stuff. Arguably the world’s most eligible royal bachelor, Prince Harry announced he’s engaged to Meghan Markle. Prepare for the glut of commemorative items. About £222 million was spent on memorabilia related to the 2011 royal wedding of the Duke and Duchess of Cambridge, reported The Telegraph.

- Beknighting another Beatle. That’s right. The Beatles’ former drummer Ringo Starr is on the list to receive knighthood during Queen Elizabeth's annual New Year's Honours ceremony, announced Rolling Stone.

What were the best and worst moments of 2017 in your opinion?

Weekly Focus - Think About It

“Your success and happiness lies in you. Resolve to keep happy, and your joy and you shall form an invincible host against difficulties.”

—Helen Keller, American author, lecturer, and activist

Best regards,

Sean M. Dowling, CFP, EA

President, The Dowling Group Wealth Management

Please feel free to forward this commentary to family, friends, or colleagues. If you would like us to add them to the list, please reply to this e-mail with their e-mail address and we will ask for their permission to be added.

- Government bonds and Treasury Bills are guaranteed by the U.S. government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value. However, the value of fund shares is not guaranteed and will fluctuate.

- Corporate bonds are considered higher risk than government bonds but normally offer a higher yield and are subject to market, interest rate and credit risk as well as additional risks based on the quality of issuer coupon rate, price, yield, maturity, and redemption features.

- These views are those of Peak Advisor Alliance, and not the presenting Representative or the Representative's Broker/Dealer, and should not be construed as investment advice.

- This newsletter was prepared by Peak Advisor Alliance. Peak Advisor Alliance is not affiliated with the named broker/dealer.

- The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. You cannot invest directly in this index.

- All indices referenced are unmanaged. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment.

- The Dow Jones Global ex-U.S. Index covers approximately 95% of the market capitalization of the 45 developed and emerging countries included in the Index.

- The 10-year Treasury Note represents debt owed by the United States Treasury to the public. Since the U.S. Government is seen as a risk-free borrower, investors use the 10-year Treasury Note as a benchmark for the long-term bond market.

- Gold represents the afternoon gold price as reported by the London Bullion Market Association. The gold price is set twice daily by the London Gold Fixing Company at 10:30 and 15:00 and is expressed in U.S. dollars per fine troy ounce.

- The Bloomberg Commodity Index is designed to be a highly liquid and diversified benchmark for the commodity futures market. The Index is composed of futures contracts on 19 physical commodities and was launched on July 14, 1998.

- The DJ Equity All REIT Total Return Index measures the total return performance of the equity subcategory of the Real Estate Investment Trust (REIT) industry as calculated by Dow Jones.

- Yahoo! Finance is the source for any reference to the performance of an index between two specific periods.

- Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

- Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

- Past performance does not guarantee future results. Investing involves risk, including loss of principal.

- You cannot invest directly in an index.

- Consult your financial professional before making any investment decision.

- Stock investing involves risk including loss of principal.

Sources:

https://www.barrons.com/articles/dow-industrials-end-solid-2017-on-a-sour-note-1514601649 (or go to https://s3-us-west-2.amazonaws.com/peakcontent/+Peak+Commentary/01-02-18_Barrons-Dow_Industrials_End_Solid_2017_on_a_Sour_Note-Footnote_1.pdf)

http://www.valuewalk.com/2017/12/when-overbought-is-bullish/

http://money.cnn.com/data/fear-and-greed/

https://www.wallstreetmojo.com/sell-side-vs-buy-side/

http://www.barrons.com/public/page/9_0210-investorsentimentreadings.html

http://www.aaii.com/sentimentsurvey

http://www.aaii.com/journal/article/is-the-aaii-sentiment-survey-a-contrarian-indicator

https://www.cnbc.com/2017/12/26/could-2018-surprise-with-the-same-outsize-gains-as-2017.html

https://nypost.com/2017/12/28/the-highs-and-lows-of-pop-culture-in-2017/

https://www.rollingstone.com/music/news/ringo-starr-bee-gees-barry-gibb-receive-knighthood-w514828

http://inspower.co/17-best-quotes-about-resolve/

ADV & Investment Objectives: Please contact The Dowling Group if there are any changes in your financial situation or investment objectives, or if you wish to impose, add or modify any reasonable restrictions to the management of your account. Our current disclosure statement is set forth on Part II of Form ADV and is available for your review upon request.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe