September 5, 2017

Week in Review: 9/1/17

Commentary

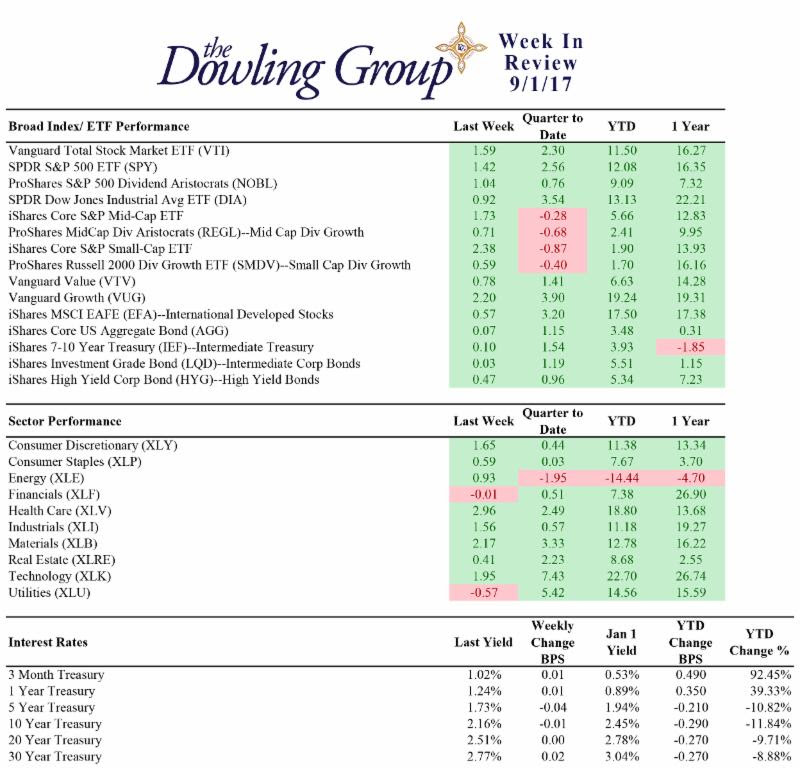

The stock market moved convincingly higher for the second week in a row as investors continued to buy the mid-August dip that pulled the major averages from their all-time highs. The Nasdaq moved back into record territory, climbing 2.7% to settle the week at a new all-time high. Meanwhile, the Russell 2000, the S&P 500, and the Dow added 2.6%, 1.4%, and 0.8%, respectively.

Eight sectors settled the week in the green—health care (+3.0%), technology (+2.1%), industrials (+1.5%), materials (+1.9%), consumer discretionary (+1.6%), energy (+0.8%), consumer staples (+0.5%), and real estate (+0.4%)—while three groups finished in the red—financials (-0.1%), utilities (-0.6%) and telecom services (-1.4%).

The week's most notable headlines in chronological order:

Monday—S&P 500 +0.1%, Nasdaq +0.3%, Dow unchanged

- Crude futures drop and gasoline futures rise after Hurricane Harvey, which hit the Texas coast over the weekend, forced the closure of many oil refineries.

- Reports indicate that Apple (AAPL) will hold a product event on September 12, in which the company is expected to unveil its much-anticipated iPhone 8.

- Gilead Sciences (GILD) announces that it will acquire Kite Pharmaceuticals (KITE) for approximately $11.9 billion, or $180.00 per share, in cash.

Tuesday—S&P 500 +0.1%, Nasdaq +0.3%, Dow +0.3%

- North Korea fires a ballistic missile over the Japanese island of Hokkaido, marking the first time since 2009 that Pyongyang has fired over Japan's main islands.

- President Trump says "all options are on the table" in response to North Korea's latest missile test.

Wednesday—S&P 500 +0.5%, Nasdaq +1.1%, Dow +0.1%

- Second estimate of second quarter GDP beats estimates (3.0% actual vs 2.7% Briefing.com consensus).

- ADP National Employment Report for August comes in better than expected (237,000 actual vs 180,000 Briefing.com consensus).

Thursday—S&P 500 +0.6%, Nasdaq +1.0%, Dow +0.3%

- The latest reading of the core PCE Price Index shows that consumer prices decelerated on a year-over-year basis in July—dropping to +1.4% from +1.5% in June.

- July personal income beats estimates (+0.4% actual vs Briefing.com consensus +0.3%) while personal spending falls short (+0.3% vs Briefing.com consensus +0.4%).

Friday—S&P 500 +0.2%, Nasdaq +0.1%, Dow +0.2%

- The Employment Situation Report for August misses estimates; nonfarm payrolls (156K actual vs 183K Briefing.com consensus).

- The ISM Manufacturing Index comes in better than expected (58.8 actual vs 56.8 Briefing.com consensus).

- Reports indicate that the White House will not attempt to shut down the government, even if it doesn't secure funding for a barrier along the U.S.-Mexico border.

Week In Review Stats

Open the weekly stats PDF here

Economic data was the focal point last week as investors received a slew of economic reports—the most notable of which were the Employment Situation Report for August and the core PCE Price Index for July. Both reports helped ease the market's rate-hike concerns, providing further evidence that inflation has been, and will continue to be, relatively sluggish.

The core PCE Price Index, which excludes food and energy, increased by 0.1% in July (consensus 0.1%), but dropped on a year-over-year basis to +1.4% from +1.5% in June. The Fed has set a year-over-year target of 2.0% for inflation so July's deceleration doesn't bode well for the notion that the Fed will be able to follow through with its forecast of one additional rate hike this year.

In addition, the August jobs report provided no signs of a pick up in inflation in the near term as it showed another relatively weak increase in average hourly earnings (0.1% actual vs 0.2% consensus). On a year-over-year basis, average hourly earnings have risen 2.5%, unchanged from the 12-month period ending in July.

The fed funds futures market currently places the chances of another rate hike this year at 41.4% and considers the June 2018 FOMC meeting as the most likely time for the next rate-hike announcement with an implied probability of 54.4%. Last week, the market expected the next rate hike to occur in June 2018 with an implied probability of 58.0%.

Looking ahead, the market's attention will likely shift from rate hikes to the Fed's balance sheet during the next FOMC meeting, which is scheduled to take place September 19-20, as the U.S. central bank is expected to announce the start of a plan to reduce its massive $4.5 trillion balance sheet.

Regards,

W. Joseph Ryan

Chief Investment Officer

The Dowling Group

Disclosures: This material represents The Dowling Group's views and opinions. These views may change without notice based on changing circumstance. The information provided should not be considered a recommendation to buy or sell any security, and should not be considered investment, legal, or tax advice. Information is obtained from sources believed to be credible and reliable, but its accuracy, completeness, and interpretation cannot be guaranteed.

It's a busy world. Our newsletter helps keep you tuned in to major market events, money-saving opportunities, filing deadlines, and other important information. One email per week and no spam — promise.

Subscribe